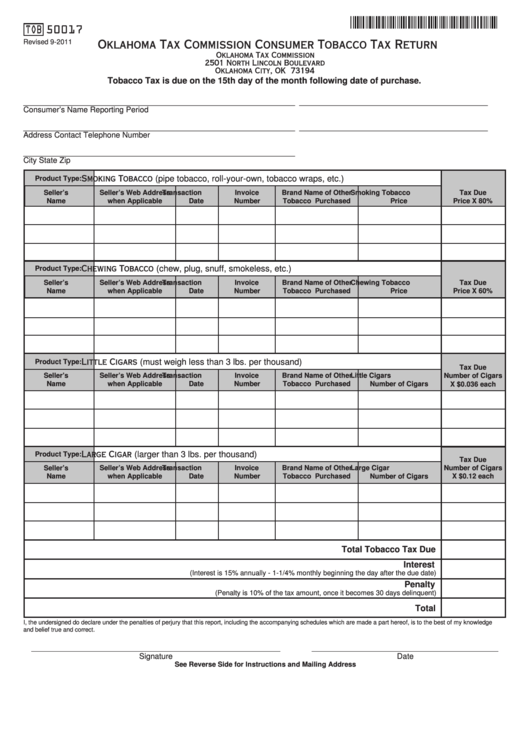

TOB 50017

Oklahoma Tax Commission Consumer Tobacco Tax Return

Revised 9-2011

Oklahoma Tax Commission

2501 North Lincoln Boulevard

Oklahoma City, OK 73194

Tobacco Tax is due on the 15th day of the month following date of purchase.

______________________________________________________________

___________________________________________

Consumer’s Name

Reporting Period

______________________________________________________________

___________________________________________

Address

Contact Telephone Number

______________________________________________________________

City

State

Zip

Smoking Tobacco (pipe tobacco, roll-your-own, tobacco wraps, etc.)

Product Type:

Seller’s

Seller’s Web Address

Transaction

Invoice

Brand Name of Other

Smoking Tobacco

Tax Due

Name

when Applicable

Date

Number

Tobacco Purchased

Price

Price X 80%

Chewing Tobacco (chew, plug, snuff, smokeless, etc.)

Product Type:

Seller’s

Seller’s Web Address

Transaction

Invoice

Brand Name of Other

Chewing Tobacco

Tax Due

Name

when Applicable

Date

Number

Tobacco Purchased

Price

Price X 60%

Little Cigars (must weigh less than 3 lbs. per thousand)

Product Type:

Tax Due

Seller’s

Seller’s Web Address

Transaction

Invoice

Brand Name of Other

Little Cigars

Number of Cigars

Name

when Applicable

Date

Number

Tobacco Purchased

Number of Cigars

X $0.036 each

Large Cigar (larger than 3 lbs. per thousand)

Product Type:

Tax Due

Seller’s

Seller’s Web Address

Transaction

Invoice

Brand Name of Other

Large Cigar

Number of Cigars

X $0.12 each

Name

when Applicable

Date

Number

Tobacco Purchased

Number of Cigars

Total Tobacco Tax Due

Interest

(Interest is 15% annually - 1-1/4% monthly beginning the day after the due date)

Penalty

(Penalty is 10% of the tax amount, once it becomes 30 days delinquent)

Total

I, the undersigned do declare under the penalties of perjury that this report, including the accompanying schedules which are made a part hereof, is to the best of my knowledge

and belief true and correct.

Signature

Date

See Reverse Side for Instructions and Mailing Address

1

1 2

2