Form S-Corp-Es - Sub-Chapter S Corporate Income And Franchise Estimated Tax Payment Voucher

ADVERTISEMENT

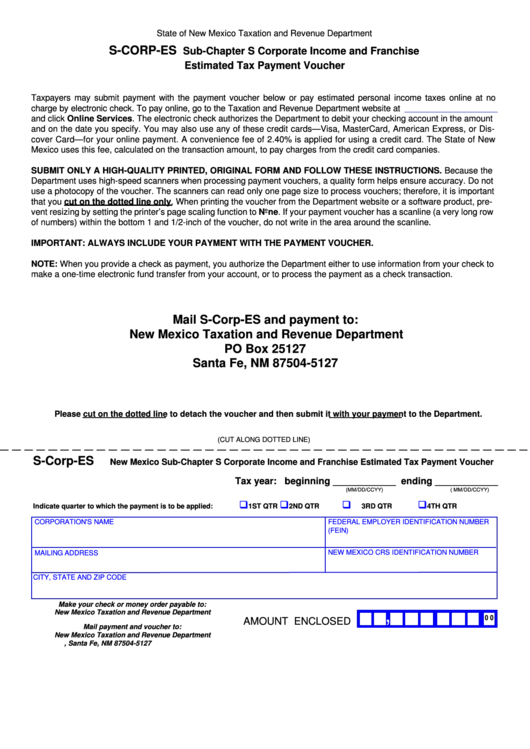

State of New Mexico Taxation and Revenue Department

S-CORP-ES

Sub-Chapter S Corporate Income and Franchise

Estimated Tax Payment Voucher

Taxpayers may submit payment with the payment voucher below or pay estimated personal income taxes online at no

charge by electronic check. To pay online, go to the Taxation and Revenue Department website at

and click Online Services. The electronic check authorizes the Department to debit your checking account in the amount

and on the date you specify. You may also use any of these credit cards—Visa, MasterCard, American Express, or Dis-

cover Card—for your online payment. A convenience fee of 2.40% is applied for using a credit card. The State of New

Mexico uses this fee, calculated on the transaction amount, to pay charges from the credit card companies.

SUBMIT ONLY A HIGH-QUALITY PRINTED, ORIGINAL FORM AND FOLLOW THESE INSTRUCTIONS. Because the

Department uses high-speed scanners when processing payment vouchers, a quality form helps ensure accuracy. Do not

use a photocopy of the voucher. The scanners can read only one page size to process vouchers; therefore, it is important

that you cut on the dotted line only. When printing the voucher from the Department website or a software product, pre-

vent resizing by setting the printer’s page scaling function to None. If your payment voucher has a scanline (a very long row

of numbers) within the bottom 1 and 1/2-inch of the voucher, do not write in the area around the scanline.

IMPORTANT: ALWAYS INCLUDE YOUR PAYMENT WITH THE PAYMENT VOUCHER.

NOTE: When you provide a check as payment, you authorize the Department either to use information from your check to

make a one-time electronic fund transfer from your account, or to process the payment as a check transaction.

Mail S-Corp-ES and payment to:

New Mexico Taxation and Revenue Department

PO Box 25127

Santa Fe, NM 87504-5127

Please cut on the dotted line to detach the voucher and then submit it with your payment to the Department.

(CUT ALONG DOTTED LINE)

S-Corp-ES

New Mexico Sub-Chapter S Corporate Income and Franchise Estimated Tax Payment Voucher

Tax year: beginning ____________ ending ____________

(MM/DD/CCYY)

( MM/DD/CCYY)

Indicate quarter to which the payment is to be applied:

1ST QTR

2ND QTR

3RD QTR

4TH QTR

CORPORATION'S NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

(FEIN)

NEW MEXICO CRS IDENTIFICATION NUMBER

MAILING ADDRESS

CITY, STATE AND ZIP CODE

Make your check or money order payable to:

,

,

.

New Mexico Taxation and Revenue Department

0 0

AMOUNT ENCLOSED

Mail payment and voucher to:

New Mexico Taxation and Revenue Department

P.O. Box 25127, Santa Fe, NM 87504-5127

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1