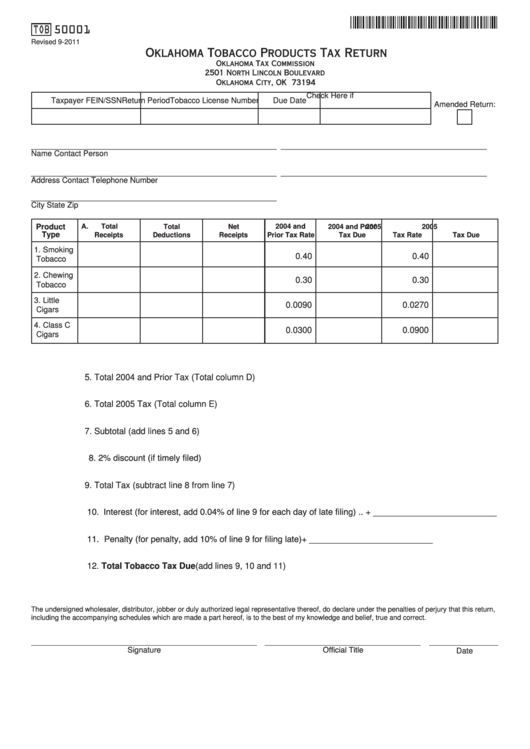

TOB 50001

Revised 9-2011

Oklahoma Tobacco Products Tax Return

Oklahoma Tax Commission

2501 North Lincoln Boulevard

Oklahoma City, OK 73194

Check Here if

Taxpayer FEIN/SSN

Return Period

Due Date

Tobacco License Number

Amended Return:

________________________________________________________

_______________________________________________

Name

Contact Person

________________________________________________________

_______________________________________________

Address

Contact Telephone Number

________________________________________________________

City

State

Zip

Product

A.

Total

B.

Total

C.

Net

2004 and

D.

2004 and Prior

2005

E.

2005

Type

Receipts

Deductions

Receipts

Prior Tax Rate

Tax Due

Tax Rate

Tax Due

1. Smoking

0.40

0.40

Tobacco

2. Chewing

0.30

0.30

Tobacco

3. Little

0.0090

0.0270

Cigars

4. Class C

0.0300

0.0900

Cigars

5. Total 2004 and Prior Tax (Total column D) ............................................. _ _________________________

6. Total 2005 Tax (Total column E) . ............................................................ _ _________________________

7. Subtotal (add lines 5 and 6) . .................................................................. _ _________________________

8. 2% discount (if timely filed) . ................................................................... _ _________________________

9. Total Tax (subtract line 8 from line 7) ..................................................... _ _________________________

1 0. Interest (for interest, add 0.04% of line 9 for each day of late filing) .. + _ _________________________

1 1. Penalty (for penalty, add 10% of line 9 for filing late).......................... + _ _________________________

1 2. Total Tobacco Tax Due (add lines 9, 10 and 11) . ................................ _ _________________________

The undersigned wholesaler, distributor, jobber or duly authorized legal representative thereof, do declare under the penalties of perjury that this return,

including the accompanying schedules which are made a part hereof, is to the best of my knowledge and belief, true and correct.

Official Title

Signature

Date

1

1 2

2