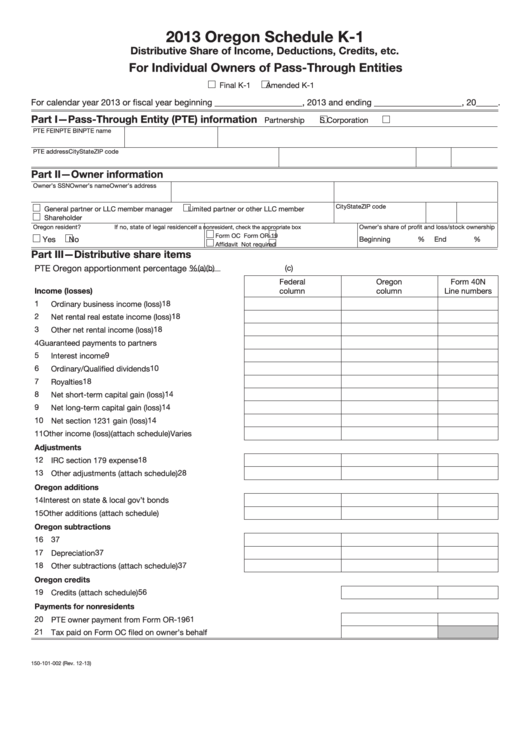

2013 Oregon Schedule K-1

Clear Form

Distributive Share of Income, Deductions, Credits, etc.

For Individual Owners of Pass-Through Entities

Final K-1

Amended K-1

For calendar year 2013 or fiscal year beginning ____________________, 2013 and ending ____________________, 20_____.

Part I—Pass-Through Entity (PTE) information

Partnership

S Corporation

PTE FEIN

PTE BIN

PTE name

PTE address

City

State

ZIP code

Part II—Owner information

Owner’s SSN

Owner’s name

Owner’s address

City

State

ZIP code

General partner or LLC member manager

Limited partner or other LLC member

Shareholder

Oregon resident?

If no, state of legal residence

Owner’s share of profit and loss/stock ownership

If a nonresident, check the appropriate box

Form OC

Form OR-19

Yes

No

Beginning

%

End

%

Affidavit

Not required

Part III—Distributive share items

PTE Oregon apportionment percentage

%

(a)

(b)

(c)

Federal

Oregon

Form 40N

Income (losses)

column

column

Line numbers

1

18

Ordinary business income (loss) ...................................

2

18

Net rental real estate income (loss) ...............................

3

18

Other net rental income (loss) .......................................

4

Guaranteed payments to partners ................................

18

5

9

Interest income ..............................................................

6

10

Ordinary/Qualified dividends .........................................

7

18

Royalties ........................................................................

8

14

Net short-term capital gain (loss) ..................................

9

14

Net long-term capital gain (loss) ...................................

10 Net section 1231 gain (loss) ..........................................

14

11 Other income (loss)(attach schedule) ............................

Varies

Adjustments

12 IRC section 179 expense ..............................................

18

13 Other adjustments (attach schedule) ............................

28

Oregon additions

14 Interest on state & local gov’t bonds .............................

31

15 Other additions (attach schedule) .................................

33

Oregon subtractions

16 U.S. government interest ..............................................

37

17 Depreciation ..................................................................

37

18 Other subtractions (attach schedule) ............................

37

Oregon credits

19 Credits (attach schedule) ............................................................................................

56

Payments for nonresidents

20 PTE owner payment from Form OR-19 ......................................................................

61

21 Tax paid on Form OC filed on owner’s behalf ............................................................

150-101-002 (Rev. 12-13)

1

1 2

2 3

3