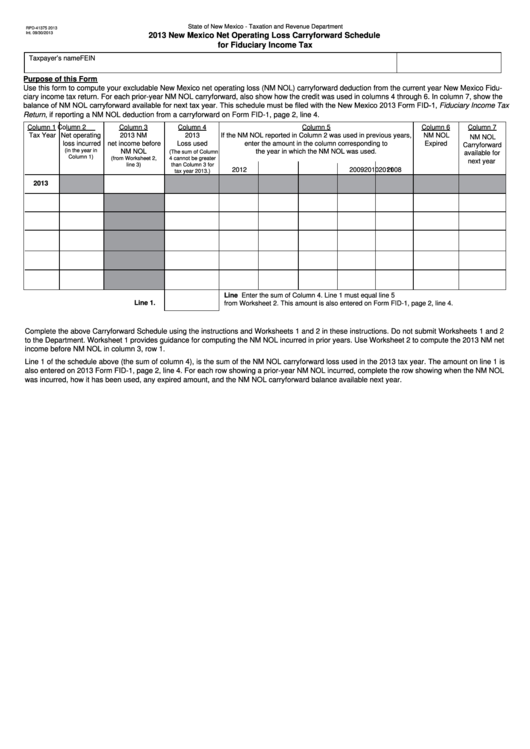

Form Rpd-41375 - New Mexico Net Operating Loss Carryforward Schedule For Fiduciary Income Tax - 2013

ADVERTISEMENT

State of New Mexico - Taxation and Revenue Department

RPD-41375 2013

Int. 09/30/2013

2013 New Mexico Net Operating Loss Carryforward Schedule

for Fiduciary Income Tax

Taxpayer’s name

FEIN

Purpose of this Form

Use this form to compute your excludable New Mexico net operating loss (NM NOL) carryforward deduction from the current year New Mexico Fidu-

ciary income tax return. For each prior-year NM NOL carryforward, also show how the credit was used in columns 4 through 6. In column 7, show the

balance of NM NOL carryforward available for next tax year. This schedule must be filed with the New Mexico 2013 Form FID-1, Fiduciary Income Tax

Return, if reporting a NM NOL deduction from a carryforward on Form FID-1, page 2, line 4.

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Tax Year

Net operating

2013 NM

2013

If the NM NOL reported in Column 2 was used in previous years,

NM NOL

NM NOL

loss incurred

net income before

Loss used

enter the amount in the column corresponding to

Expired

Carryforward

(in the year in

NM NOL

the year in which the NM NOL was used.

(The sum of Column

available for

Column 1)

(from Worksheet 2,

4 cannot be greater

next year

line 3)

than Column 3 for

2012

2011

2010

2009

2008

tax year 2013.)

2013

Line 1. Loss used during 2013 tax year. Enter the sum of Column 4. Line 1 must equal line 5

from Worksheet 2. This amount is also entered on Form FID-1, page 2, line 4.

Line 1.

Complete the above Carryforward Schedule using the instructions and Worksheets 1 and 2 in these instructions. Do not submit Worksheets 1 and 2

to the Department. Worksheet 1 provides guidance for computing the NM NOL incurred in prior years. Use Worksheet 2 to compute the 2013 NM net

income before NM NOL in column 3, row 1.

Line 1 of the schedule above (the sum of column 4), is the sum of the NM NOL carryforward loss used in the 2013 tax year. The amount on line 1 is

also entered on 2013 Form FID-1, page 2, line 4. For each row showing a prior-year NM NOL incurred, complete the row showing when the NM NOL

was incurred, how it has been used, any expired amount, and the NM NOL carryforward balance available next year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4