Form Ct-1120 Edpc - Electronic Data Processing Equipment Property Tax Credit - 2013

ADVERTISEMENT

Department of Revenue Services

2013

State of Connecticut

Form CT-1120 EDPC

Electronic Data Processing Equipment

(Rev. 12/13)

Property Tax Credit

For Income Year Beginning: _______________________ , 2013 and Ending: ________________________ , _________ .

Connecticut Tax Registration Number

Corporation name

Complete this form in blue or black ink only.

any other equipment reported as Code 20 on the Personal Property

Declaration; prescribed by the Secretary of the Office of Policy and

Use Form CT-1120 EDPC to claim the credit available under Conn.

Management.

Gen. Stat. §12-217t, for personal property taxes paid on electronic

data processing equipment to a Connecticut municipality during the

Credit Computation

income year. Attach it to Form CT-1120K, Business Tax Credit

The electronic data processing property tax credit is allowed only after

Summary or Form CT-207K, Insurance / Health Care Tax Credit

the application of all other tax credits. The allowable credit is applied

Schedule.

first against the corporation business tax and then may be applied

against the taxes administered under Chapters 207, 208, 208a, 209,

In the case of leased electronic data processing equipment, the

210, 211, or 212 of the Connecticut General Statutes. Any remaining

lessee, not the lessor, is entitled to claim this credit if the lease

credit balance that exceeds the credit applied may be carried forward

by its terms or by operation imposes on the lessee the cost of the

to five succeeding income years.

personal property taxes on the equipment. However, the lessor and

lessee may elect, in writing, that the lessor may claim the credit. The

Additional Information

lessor shall provide a copy of the written election upon the request of

S e e t h e G u i d e t o C o n n e c t i c u t B u s i n e s s Ta x C r e d i t s

the Department of Revenue Services (DRS).

a v a i l a b l e o n t h e D R S w e b s i t e a t w w w . c t . g o v / d r s ,

Definition

or contact DRS at 1-800-382-9463 (Connecticut calls outside the

Greater Hartford calling area only) or 860-297-5962 (from anywhere).

Electronic data processing equipment means computers, printers,

peripheral computer equipment, bundled software, and any computer-

based equipment acting as a computer as defined in IRC §168, and

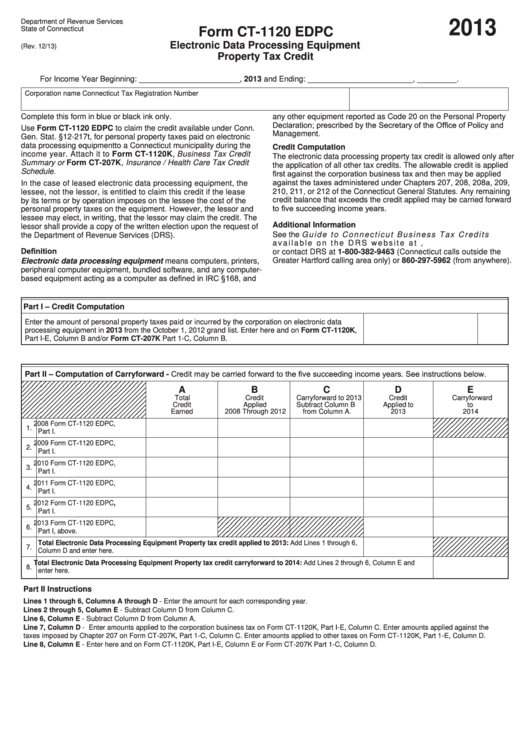

Part I – Credit Computation

Enter the amount of personal property taxes paid or incurred by the corporation on electronic data

processing equipment in 2013 from the October 1, 2012 grand list. Enter here and on Form CT-1120K,

Part I-E, Column B and/or Form CT-207K Part 1-C, Column B.

Part II – Computation of Carryforward - Credit may be carried forward to the five succeeding income years. See instructions below.

A

B

C

D

E

Total

Credit

Carryforward to 2013

Credit

Carryforward

Credit

Applied

Subtract Column B

Applied to

to

2008 Through 2012

Earned

from Column A.

2013

2014

2008 Form CT-1120 EDPC,

1.

Part I.

2009 Form CT-1120 EDPC,

2.

Part I.

2010 Form CT-1120 EDPC,

3.

Part I.

2011 Form CT-1120 EDPC,

4.

Part I.

2012 Form CT-1120 EDPC,

5.

Part I.

2013 Form CT-1120 EDPC,

6.

Part I, above.

Total Electronic Data Processing Equipment Property tax credit applied to 2013: Add Lines 1 through 6,

7.

Column D and enter here.

Total Electronic Data Processing Equipment Property tax credit carryforward to 2014: Add Lines 2 through 6, Column E and

8.

enter here.

Part II Instructions

Lines 1 through 6, Columns A through D - Enter the amount for each corresponding year.

Lines 2 through 5, Column E - Subtract Column D from Column C.

Line 6, Column E - Subtract Column D from Column A.

Line 7, Column D - Enter amounts applied to the corporation business tax on Form CT-1120K, Part I-E, Column C. Enter amounts applied against the

taxes imposed by Chapter 207 on Form CT-207K, Part 1-C, Column C. Enter amounts applied to other taxes on Form CT-1120K, Part 1-E, Column D.

Line 8, Column E - Enter here and on Form CT-1120K, Part I-E, Column E or Form CT-207K Part 1-C, Column D.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1