Sc Sch.tc-54 - Credit For Manufacturing Renewable Energy Systems

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

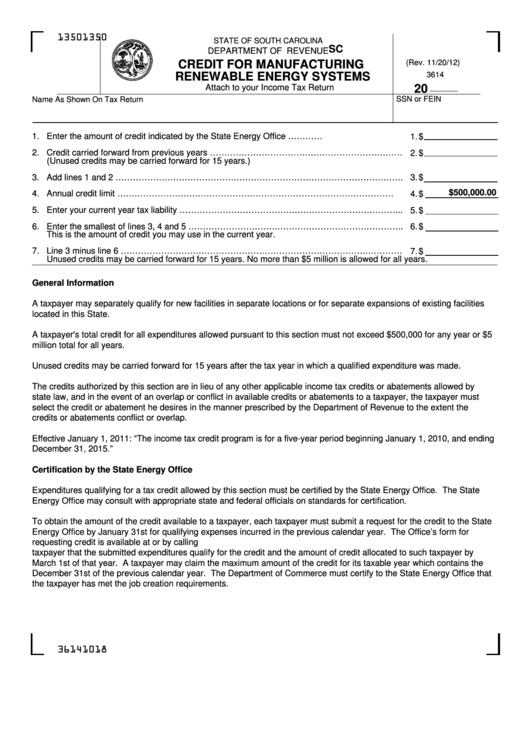

SC SCH.TC-54

DEPARTMENT OF REVENUE

CREDIT FOR MANUFACTURING

(Rev. 11/20/12)

3614

RENEWABLE ENERGY SYSTEMS

Attach to your Income Tax Return

20

SSN or FEIN

Name As Shown On Tax Return

1. Enter the amount of credit indicated by the State Energy Office ………….................................

1.

$

2. Credit carried forward from previous years ………………………………………………………….

2.

$

(Unused credits may be carried forward for 15 years.)

3. Add lines 1 and 2 ……………………………………………………………………………………….

3.

$

$500,000.00

4. Annual credit limit ……………………………………………………………………………………....

4.

$

5. Enter your current year tax liability …………………………………………………………………...

5.

$

6. Enter the smallest of lines 3, 4 and 5 ………………………….……………………………………..

6.

$

This is the amount of credit you may use in the current year.

7. Line 3 minus line 6 ………………………………………………………………………….………….

7.

$

Unused credits may be carried forward for 15 years. No more than $5 million is allowed for all years.

General Information

A taxpayer may separately qualify for new facilities in separate locations or for separate expansions of existing facilities

located in this State.

A taxpayer's total credit for all expenditures allowed pursuant to this section must not exceed $500,000 for any year or $5

million total for all years.

Unused credits may be carried forward for 15 years after the tax year in which a qualified expenditure was made.

The credits authorized by this section are in lieu of any other applicable income tax credits or abatements allowed by

state law, and in the event of an overlap or conflict in available credits or abatements to a taxpayer, the taxpayer must

select the credit or abatement he desires in the manner prescribed by the Department of Revenue to the extent the

credits or abatements conflict or overlap.

Effective January 1, 2011: “The income tax credit program is for a five-year period beginning January 1, 2010, and ending

December 31, 2015.”

Certification by the State Energy Office

Expenditures qualifying for a tax credit allowed by this section must be certified by the State Energy Office. The State

Energy Office may consult with appropriate state and federal officials on standards for certification.

To obtain the amount of the credit available to a taxpayer, each taxpayer must submit a request for the credit to the State

Energy Office by January 31st for qualifying expenses incurred in the previous calendar year. The Office’s form for

requesting credit is available at or by calling 803-737-8030. The State Energy Office must notify the

taxpayer that the submitted expenditures qualify for the credit and the amount of credit allocated to such taxpayer by

March 1st of that year. A taxpayer may claim the maximum amount of the credit for its taxable year which contains the

December 31st of the previous calendar year. The Department of Commerce must certify to the State Energy Office that

the taxpayer has met the job creation requirements.

36141018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2