Form F5000.28t - Floor Stocks Tax Return - 2002

ADVERTISEMENT

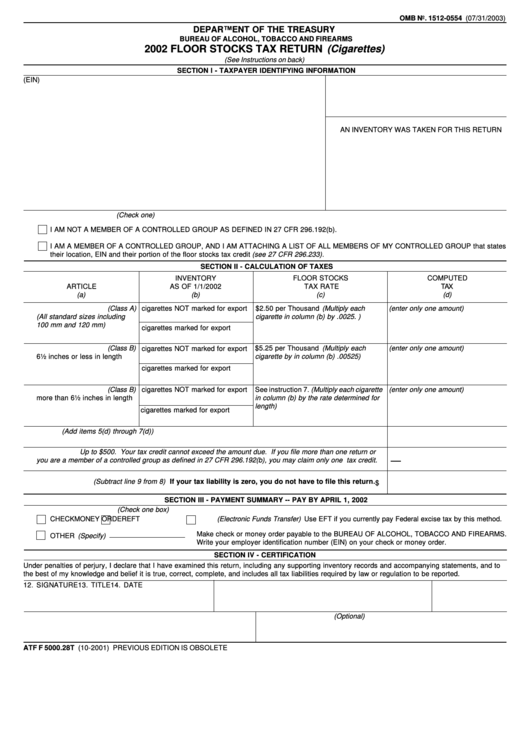

OMB No. 1512-0554 (07/31/2003)

DEPARTMENT OF THE TREASURY

BUREAU OF ALCOHOL, TOBACCO AND FIREARMS

2002 FLOOR STOCKS TAX RETURN (Cigarettes)

(See Instructions on back)

SECTION I - TAXPAYER IDENTIFYING INFORMATION

1. NAME AND ADDRESS

2. EMPLOYER IDENTIFICATION NUMBER (EIN)

3. SPECIFY THE NUMBER OF LOCATIONS WHERE

AN INVENTORY WAS TAKEN FOR THIS RETURN

4. CONTROLLED GROUP (Check one)

I AM NOT A MEMBER OF A CONTROLLED GROUP AS DEFINED IN 27 CFR 296.192(b).

I AM A MEMBER OF A CONTROLLED GROUP, AND I AM ATTACHING A LIST OF ALL MEMBERS OF MY CONTROLLED GROUP that states

their location, EIN and their portion of the floor stocks tax credit (see 27 CFR 296.233) .

SECTION II - CALCULATION OF TAXES

INVENTORY

FLOOR STOCKS

COMPUTED

TAX RATE

TAX

ARTICLE

AS OF 1/1/2002

(a)

(b)

(c)

(d)

5. SMALL CIGARETTES (Class A)

cigarettes NOT marked for export

$2.50 per Thousand (Multiply each

(enter only one amount)

(All standard sizes including

cigarette in column (b) by .0025. )

100 mm and 120 mm)

cigarettes marked for export

6. LARGE CIGARETTES (Class B)

$5.25 per Thousand (Multiply each

(enter only one amount)

cigarettes NOT marked for export

6½ inches or less in length

cigarette by in column (b) .00525)

cigarettes marked for export

7. LARGE CIGARETTES (Class B)

cigarettes NOT marked for export

See instruction 7. (Multiply each cigarette

(enter only one amount)

more than 6½ inches in length

in column (b) by the rate determined for

length)

cigarettes marked for export

8. TOTAL (Add items 5(d) through 7(d))

9. TAX CREDIT Up to $500. Your tax credit cannot exceed the amount due. If you file more than one return or

you are a member of a controlled group as defined in 27 CFR 296.192(b), you may claim only one tax credit.

10. TOTAL TAX DUE (Subtract line 9 from 8) If your tax liability is zero, you do not have to file this return.

$

SECTION III - PAYMENT SUMMARY -- PAY BY APRIL 1, 2002

11. METHOD OF PAYMENT (Check one box)

EFT (Electronic Funds Transfer) Use EFT if you currently pay Federal excise tax by this method.

CHECK

MONEY ORDER

Make check or money order payable to the BUREAU OF ALCOHOL, TOBACCO AND FIREARMS.

OTHER (Specify)

Write your employer identification number (EIN) on your check or money order.

SECTION IV - CERTIFICATION

Under penalties of perjury, I declare that I have examined this return, including any supporting inventory records and accompanying statements, and to

the best of my knowledge and belief it is true, correct, complete, and includes all tax liabilities required by law or regulation to be reported.

12. SIGNATURE

13. TITLE

14. DATE

15. DAYTIME TELEPHONE NUMBER

16. E-MAIL ADDRESS (Optional)

ATF F 5000.28T (10-2001) PREVIOUS EDITION IS OBSOLETE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1