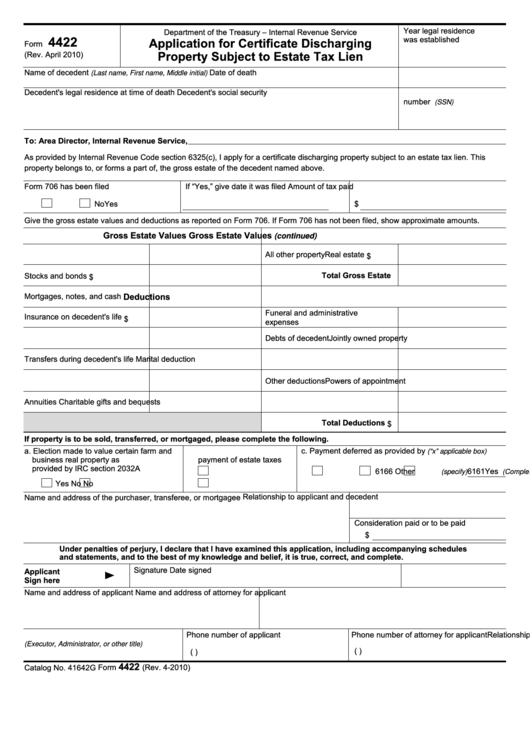

Year legal residence

Department of the Treasury – Internal Revenue Service

4422

was established

Application for Certificate Discharging

Form

Property Subject to Estate Tax Lien

(Rev. April 2010)

Name of decedent

Date of death

(Last name, First name, Middle initial)

Decedent's social security

Decedent's legal residence at time of death

number

(SSN)

To: Area Director, Internal Revenue Service,

As provided by Internal Revenue Code section 6325(c), I apply for a certificate discharging property subject to an estate tax lien. This

property belongs to, or forms a part of, the gross estate of the decedent named above.

Form 706 has been filed

If “Yes,” give date it was filed

Amount of tax paid

Yes

No

$

Give the gross estate values and deductions as reported on Form 706. If Form 706 has not been filed, show approximate amounts.

Gross Estate Values

Gross Estate Values

(continued)

Real estate

All other property

$

Total Gross Estate

Stocks and bonds

$

Mortgages, notes, and cash

Deductions

Funeral and administrative

Insurance on decedent's life

$

expenses

Jointly owned property

Debts of decedent

Transfers during decedent's life

Marital deduction

Powers of appointment

Other deductions

Annuities

Charitable gifts and bequests

Total Deductions

$

If property is to be sold, transferred, or mortgaged, please complete the following.

a. Election made to value certain farm and

b. Request granted to defer

c. Payment deferred as provided by

(“x” applicable box)

business real property as

payment of estate taxes

provided by IRC section 2032A

Yes

6161

6166

Other

(Complete Item c.)

(specify)

Yes

No

No

Relationship to applicant and decedent

Name and address of the purchaser, transferee, or mortgagee

Consideration paid or to be paid

$

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules

and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature

Date signed

Applicant

Sign here

Name and address of applicant

Name and address of attorney for applicant

Relationship of applicant to estate

Phone number of applicant

Phone number of attorney for applicant

(Executor, Administrator, or other title)

(

)

(

)

4422

Catalog No. 41642G

Form

(Rev. 4-2010)

1

1 2

2