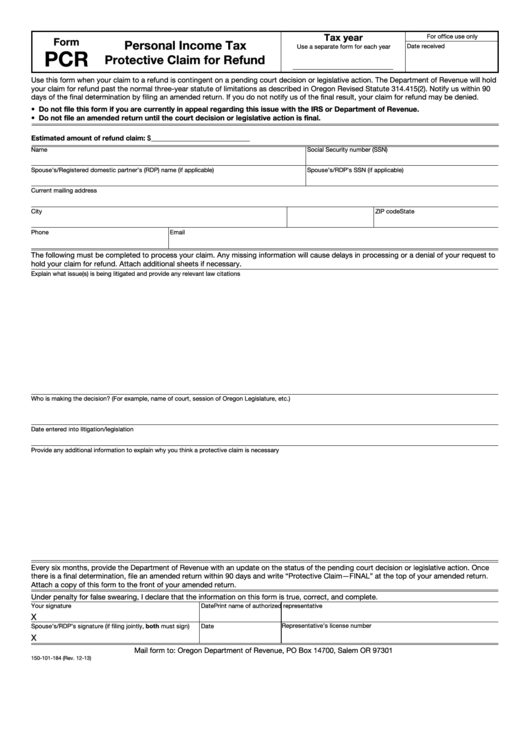

Clear form

Tax year

For office use only

Form

Personal Income Tax

Date received

Use a separate form for each year

PCR

Protective Claim for Refund

Use this form when your claim to a refund is contingent on a pending court decision or legislative action. The Department of Revenue will hold

your claim for refund past the normal three-year statute of limitations as described in Oregon Revised Statute 314.415(2). Notify us within 90

days of the final determination by filing an amended return. If you do not notify us of the final result, your claim for refund may be denied.

• Do not file this form if you are currently in appeal regarding this issue with the IRS or Department of Revenue.

• Do not file an amended return until the court decision or legislative action is final.

Estimated amount of refund claim: $____________________________

Name

Social Security number (SSN)

Spouse’s/Registered domestic partner’s (RDP) name (if applicable)

Spouse’s/RDP’s SSN (if applicable)

Current mailing address

City

State

ZIP code

Phone

Email

The following must be completed to process your claim. Any missing information will cause delays in processing or a denial of your request to

hold your claim for refund. Attach additional sheets if necessary.

Explain what issue(s) is being litigated and provide any relevant law citations

Who is making the decision? (For example, name of court, session of Oregon Legislature, etc.)

Date entered into litigation/legislation

Provide any additional information to explain why you think a protective claim is necessary

Every six months, provide the Department of Revenue with an update on the status of the pending court decision or legislative action. Once

there is a final determination, file an amended return within 90 days and write “Protective Claim—FINAL” at the top of your amended return.

Attach a copy of this form to the front of your amended return.

Under penalty for false swearing, I declare that the information on this form is true, correct, and complete.

Your signature

Date

Print name of authorized representative

X

Representative’s license number

Spouse’s/RDP’s signature (if filing jointly, both must sign)

Date

X

Mail form to: Oregon Department of Revenue, PO Box 14700, Salem OR 97301

150-101-184 (Rev. 12-13)

1

1