Form Rpd-41334 - Advanced Energy Tax Credit Claim Form With Schedules

ADVERTISEMENT

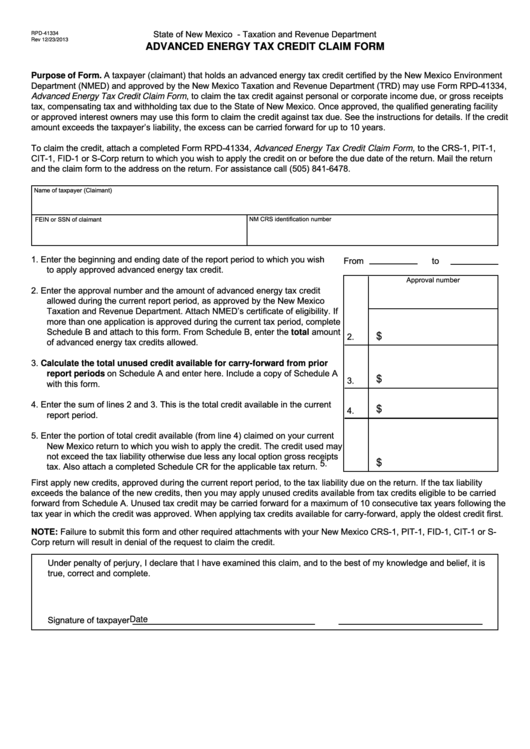

State of New Mexico - Taxation and Revenue Department

RPD-41334

Rev 12/23/2013

ADVANCED ENERGY TAX CREDIT CLAIM FORM

Purpose of Form. A taxpayer (claimant) that holds an advanced energy tax credit certified by the New Mexico Environment

Department (NMED) and approved by the New Mexico Taxation and Revenue Department (TRD) may use Form RPD-41334,

Advanced Energy Tax Credit Claim Form, to claim the tax credit against personal or corporate income due, or gross receipts

tax, compensating tax and withholding tax due to the State of New Mexico. Once approved, the qualified generating facility

or approved interest owners may use this form to claim the credit against tax due. See the instructions for details. If the credit

amount exceeds the taxpayer’s liability, the excess can be carried forward for up to 10 years.

To claim the credit, attach a completed Form RPD-41334, Advanced Energy Tax Credit Claim Form, to the CRS-1, PIT-1,

CIT-1, FID-1 or S-Corp return to which you wish to apply the credit on or before the due date of the return. Mail the return

and the claim form to the address on the return. For assistance call (505) 841-6478.

Name of taxpayer (Claimant)

NM CRS identification number

FEIN or SSN of claimant

1. Enter the beginning and ending date of the report period to which you wish

From

to

to apply approved advanced energy tax credit.

Approval number

2. Enter the approval number and the amount of advanced energy tax credit

allowed during the current report period, as approved by the New Mexico

Taxation and Revenue Department. Attach NMED’s certificate of eligibility. If

more than one application is approved during the current tax period, complete

Schedule B and attach to this form. From Schedule B, enter the total amount

$

2.

of advanced energy tax credits allowed.

3. Calculate the total unused credit available for carry-forward from prior

report periods on Schedule A and enter here. Include a copy of Schedule A

$

3.

with this form.

4. Enter the sum of lines 2 and 3. This is the total credit available in the current

$

4.

report period.

5. Enter the portion of total credit available (from line 4) claimed on your current

New Mexico return to which you wish to apply the credit. The credit used may

not exceed the tax liability otherwise due less any local option gross receipts

$

5.

tax. Also attach a completed Schedule CR for the applicable tax return.

First apply new credits, approved during the current report period, to the tax liability due on the return. If the tax liability

exceeds the balance of the new credits, then you may apply unused credits available from tax credits eligible to be carried

forward from Schedule A. Unused tax credit may be carried forward for a maximum of 10 consecutive tax years following the

tax year in which the credit was approved. When applying tax credits available for carry-forward, apply the oldest credit first.

NOTE: Failure to submit this form and other required attachments with your New Mexico CRS-1, PIT-1, FID-1, CIT-1 or S-

Corp return will result in denial of the request to claim the credit.

Under penalty of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is

true, correct and complete.

Date

Signature of taxpayer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4