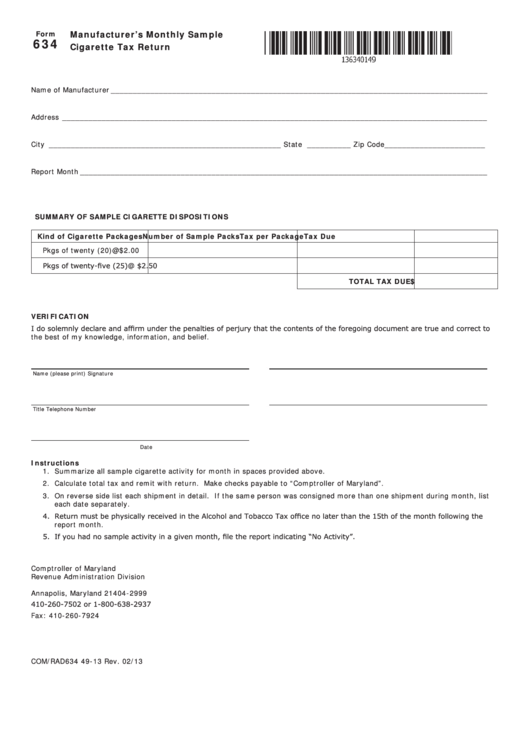

Manufacturer’s Monthly Sample

Form

634

Cigarette Tax Return

Name of Manufacturer ______________________________________________________________________________________

Address _________________________________________________________________________________________________

City _____________________________________________________ State __________ Zip Code_______________________

Report Month _____________________________________________________________________________________________

SUMMARY OF SAMPLE CIGARETTE DISPOSITIONS

Kind of Cigarette Packages

Number of Sample Packs

Tax per Package

Tax Due

Pkgs of twenty (20)

@ $2.00

Pkgs of twenty-five (25)

@ $2.50

TOTAL TAX DUE

$

VERIFICATION

I do solemnly declare and affirm under the penalties of perjury that the contents of the foregoing document are true and correct to

the best of my knowledge, information, and belief.

Name (please print)

Signature

Title

Telephone Number

Date

Instructions

1. Summarize all sample cigarette activity for month in spaces provided above.

2. Calculate total tax and remit with return. Make checks payable to “Comptroller of Maryland”.

3. On reverse side list each shipment in detail. If the same person was consigned more than one shipment during month, list

each date separately.

4. Return must be physically received in the Alcohol and Tobacco Tax office no later than the 15th of the month following the

report month.

5. If you had no sample activity in a given month, file the report indicating “No Activity”.

Comptroller of Maryland

Revenue Administration Division

P.O. Box 2999

Annapolis, Maryland 21404-2999

410-260-7502 or 1-800-638-2937

Fax: 410-260-7924

COM/RAD634

49-13

Rev. 02/13

1

1 2

2