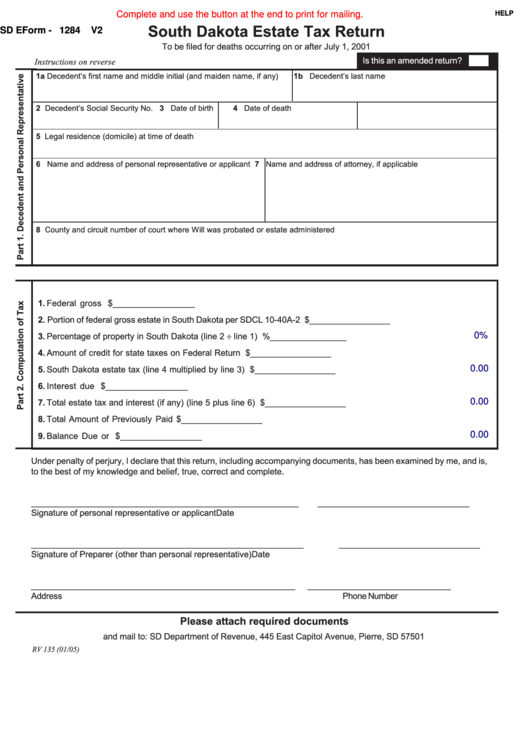

Complete and use the button at the end to print for mailing.

HELP

South Dakota Estate Tax Return

SD EForm - 1284

V2

To be filed for deaths occurring on or after July 1, 2001

Is this an amended return?

Instructions on reverse

1a Decedent’s first name and middle initial (and maiden name, if any)

1b Decedent’s last name

2 Decedent’s Social Security No.

3 Date of birth

4 Date of death

5 Legal residence (domicile) at time of death

6 Name and address of personal representative or applicant

7 Name and address of attorney, if applicable

8 County and circuit number of court where Will was probated or estate administered

1. Federal gross estate..............................................................................................................$_________________

2. Portion of federal gross estate in South Dakota per SDCL 10-40A-2 ..........................................$_________________

3. Percentage of property in South Dakota (line 2 ÷ line 1) ............................................................%________________

0%

4. Amount of credit for state taxes on Federal Return ................................................................. $_________________

5. South Dakota estate tax (line 4 multiplied by line 3) ................................................................ $_________________

0.00

6. Interest due ......................................................................................................................... $_________________

0.00

7. Total estate tax and interest (if any) (line 5 plus line 6) .............................................................$_________________

8. Total Amount of Previously Paid Tax........................................................................................$_________________

0.00

9. Balance Due or Refund..........................................................................................................$_________________

Under penalty of perjury, I declare that this return, including accompanying documents, has been examined by me, and is,

to the best of my knowledge and belief, true, correct and complete.

_________________________________________________________

________________________________

Signature of personal representative or applicant

Date

__________________________________________________________

______________________________

Signature of Preparer (other than personal representative)

Date

___________________________________________________________

________________________________

Address

Phone Number

Please attach required documents

and mail to: SD Department of Revenue, 445 East Capitol Avenue, Pierre, SD 57501

RV 135 (01/05)

1

1 2

2