Instructions And Essential Information For Form St-3

ADVERTISEMENT

INSTRUCTIONS AND ESSENTIAL INFORMATION FOR FORM ST-3

(9/30/99)

These are new instructions. Please read carefully.

- Sales of musical instruments and office equipment sold to religious

INTRODUCTION

organizations, and

This year the South Carolina Department of Revenue is requiring

taxpayers to report their taxes on Form ST-3 and Form ST-389, if

- Construction contracts (Must have received prior Department approval.)

applicable.

- Sales of certain foods are exempt from the 1% School District Local Tax.

Form ST-3 is preprinted with your firm's name, address, and retail license

Sales of food which may be lawfully purchased with USDA food stamps

or use tax registration number, and Federal Employer Identification (FEI).

come under this exemption. This exemption applies to everyone, not just

If any information is incorrect, please draw a line through any incorrect

persons using food stamps.

information and enter corrections on your return.

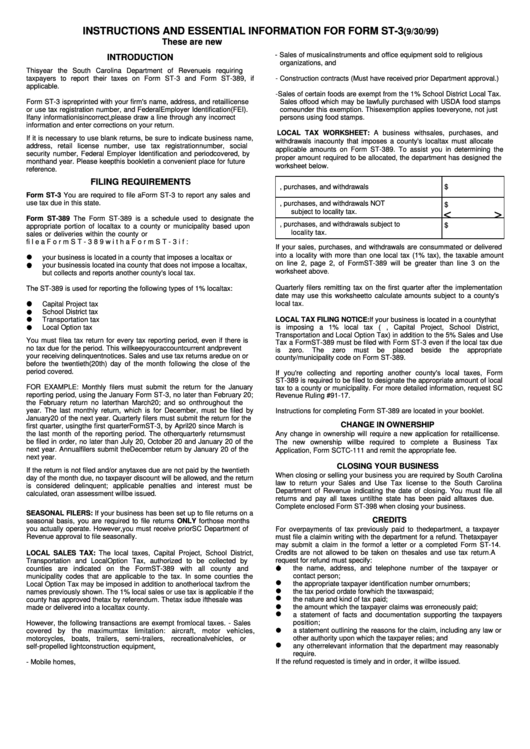

LOCAL TAX WORKSHEET: A business with sales, purchases, and

If it is necessary to use blank returns, be sure to indicate business name,

withdrawals in a county that imposes a county's local tax must allocate

address, retail license number, use tax registration number, social

applicable amounts on Form ST-389. To assist you in determining the

security number, Federal Employer Identification and period covered, by

proper amount required to be allocated, the department has designed the

month and year. Please keep this booklet in a convenient place for future

worksheet below.

reference.

FILING REQUIREMENTS

1. Total sales, purchases, and withdrawals

$

Form ST-3 You are required to file a Form ST-3 to report any sales and

use tax due in this state.

2. Minus sales, purchases, and withdrawals NOT

$

<

>

subject to locality tax.

Form ST-389 The Form ST-389 is a schedule used to designate the

3. Sales, purchases, and withdrawals subject to

$

appropriate portion of local tax to a county or municipality based upon

locality tax.

sales or deliveries within the county or municipality. You are required to

file a Form ST-389 with a Form ST-3 if:

If your sales, purchases, and withdrawals are consummated or delivered

into a locality with more than one local tax (1% tax), the taxable amount

your business is located in a county that imposes a local tax or

on line 2, page 2, of Form ST-389 will be greater than line 3 on the

your business is located in a county that does not impose a local tax,

worksheet above.

but collects and reports another county's local tax.

Quarterly filers remitting tax on the first quarter after the implementation

The ST-389 is used for reporting the following types of 1% local tax:

date may use this worksheet to calculate amounts subject to a county's

Capital Project tax

local tax.

School District tax

Transportation tax

LOCAL TAX FILING NOTICE: If your business is located in a county that

Local Option tax

is imposing a 1% local tax (i.e., Capital Project, School District,

Transportation and Local Option Tax) in addition to the 5% Sales and Use

You must file a tax return for every tax reporting period, even if there is

Tax a Form ST-389 must be filed with Form ST-3 even if the local tax due

no tax due for the period. This will keep your account current and prevent

is

zero.

The

zero

must

be

placed

beside

the

appropriate

your receiving delinquent notices. Sales and use tax returns are due on or

county/municipality code on Form ST-389.

before the twentieth (20th) day of the month following the close of the

period covered.

If you're collecting and reporting another county's local taxes, Form

ST-389 is required to be filed to designate the appropriate amount of local

FOR EXAMPLE: Monthly filers must submit the return for the January

tax to a county or municipality. For more detailed information, request SC

reporting period, using the January Form ST-3, no later than February 20;

Revenue Ruling #91-17.

the February return no later than March 20; and so on throughout the

year. The last monthly return, which is for December, must be filed by

Instructions for completing Form ST-389 are located in your booklet.

January 20 of the next year. Quarterly filers must submit the return for the

CHANGE IN OWNERSHIP

first quarter, using the first quarter Form ST-3, by April 20 since March is

the last month of the reporting period. The other quarterly returns must

Any change in ownership will require a new application for retail license.

be filed in order, no later than July 20, October 20 and January 20 of the

The new ownership will be required to complete a Business Tax

next year. Annual filers submit the December return by January 20 of the

Application, Form SCTC-111 and remit the appropriate fee.

next year.

CLOSING YOUR BUSINESS

If the return is not filed and/or any taxes due are not paid by the twentieth

When closing or selling your business you are required by South Carolina

day of the month due, no taxpayer discount will be allowed, and the return

law to return your Sales and Use Tax license to the South Carolina

is considered delinquent; applicable penalties and interest must be

Department of Revenue indicating the date of closing. You must file all

calculated, or an assessment will be issued.

returns and pay all taxes until the state has been paid all taxes due.

Complete enclosed Form ST-398 when closing your business.

SEASONAL FILERS: If your business has been set up to file returns on a

CREDITS

seasonal basis, you are required to file returns ONLY for those months

you actually operate. However, you must receive prior SC Department of

For overpayments of tax previously paid to the department, a taxpayer

Revenue approval to file seasonally.

must file a claim in writing with the department for a refund. The taxpayer

may submit a claim in the form of a letter or a completed Form ST-14.

Credits are not allowed to be taken on the sales and use tax return. A

LOCAL SALES TAX: The local taxes, Capital Project, School District,

request for refund must specify:

Transportation and Local Option Tax, authorized to be collected by

the name, address, and telephone number of the taxpayer or

counties are indicated on the Form ST-389 with all county and

contact person;

municipality codes that are applicable to the tax. In some counties the

the appropriate taxpayer identification number or numbers;

Local Option Tax may be imposed in addition to another local tax from the

the tax period or date for which the tax was paid;

names previously shown. The 1% local sales or use tax is applicable if the

the nature and kind of tax paid;

county has approved the tax by referendum. The tax is due if the sale was

the amount which the taxpayer claims was erroneously paid;

made or delivered into a local tax county.

a statement of facts and documentation supporting the taxpayers

position;

However, the following transactions are exempt from local taxes. - Sales

a statement outlining the reasons for the claim, including any law or

covered by the maximum tax limitation: aircraft, motor vehicles,

other authority upon which the taxpayer relies; and

motorcycles, boats, trailers, semi-trailers, recreational vehicles, or

any other relevant information that the department may reasonably

self-propelled light construction equipment,

require.

If the refund requested is timely and in order, it will be issued.

- Mobile homes,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2