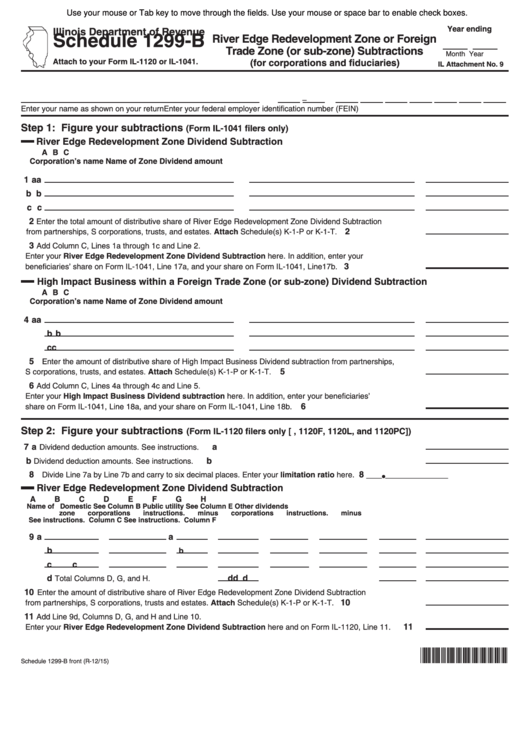

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Year ending

Illinois Department of Revenue

River Edge Redevelopment Zone or Foreign

Schedule 1299-B

Trade Zone (or sub-zone) Subtractions

Month

Year

(for corporations and fiduciaries)

Attach to your Form IL-1120 or IL-1041.

IL Attachment No. 9

–

Enter your name as shown on your return

Enter your federal employer identification number (FEIN)

Step 1: Figure your subtractions

(Form IL-1041 filers only)

River Edge Redevelopment Zone Dividend Subtraction

A

B

C

Corporation’s name

Name of Zone

Dividend amount

1 a

a

b

b

c

c

2

Enter the total amount of distributive share of River Edge Redevelopment Zone Dividend Subtraction

2

from partnerships, S corporations, trusts, and estates. Attach Schedule(s) K-1-P or K-1-T.

3

Add Column C, Lines 1a through 1c and Line 2.

Enter your River Edge Redevelopment Zone Dividend Subtraction here. In addition, enter your

3

beneficiaries’ share on Form IL-1041, Line 17a, and your share on Form IL-1041, Line17b.

High Impact Business within a Foreign Trade Zone (or sub-zone) Dividend Subtraction

A

B

C

Corporation’s name

Name of Zone

Dividend amount

4 a

a

b

b

c

c

5

Enter the amount of distributive share of High Impact Business Dividend subtraction from partnerships,

5

S corporations, trusts, and estates. Attach Schedule(s) K-1-P or K-1-T.

6

Add Column C, Lines 4a through 4c and Line 5.

Enter your High Impact Business Dividend subtraction here. In addition, enter your beneficiaries’

6

share on Form IL-1041, Line 18a, and your share on Form IL-1041, Line 18b.

Step 2: Figure your subtractions

(Form IL-1120 filers only [U.S. Forms 1120, 1120F, 1120L, and 1120PC])

7 a

a

Dividend deduction amounts. See instructions.

b

b

Dividend deduction amounts. See instructions.

___ • ____________

8

8

Divide Line 7a by Line 7b and carry to six decimal places. Enter your limitation ratio here.

River Edge Redevelopment Zone Dividend Subtraction

A

B

C

D

E

F

G

H

Name of

Domestic

See

Column B

Public utility

See

Column E

Other dividends

zone

corporations

instructions.

minus

corporations

instructions.

minus

See instructions.

Column C See instructions.

Column F

9 a

a

b

b

c

c

d

d

d

d

Total Columns D, G, and H.

10

Enter the amount of distributive share of River Edge Redevelopment Zone Dividend Subtraction

10

from partnerships, S corporations, trusts and estates. Attach Schedule(s) K-1-P or K-1-T.

11

Add Line 9d, Columns D, G, and H and Line 10.

11

Enter your River Edge Redevelopment Zone Dividend Subtraction here and on Form IL-1120, Line 11.

*534101110*

Schedule 1299-B front (R-12/15)

1

1 2

2