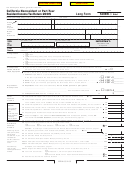

Form 540nr Draft - California Nonresident Or Part-Year Resident Income Tax Return - 2016 Page 3

ADVERTISEMENT

Your name: ______________________________________Your SSN or ITIN: ______________________________

121 AMOUNT YOU OWE. Add line 104 and line 120. See instructions. Do Not Send Cash.

.

,

,

00

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001 . . . . . . . . . . . . . . .

121

Pay Online – Go to ftb.ca.gov for more information.

.

,

,

00

125 REFUND OR NO AMOUNT DUE. Subtract line 120 from line 103. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

125

Mail to:

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-0001

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip. See instructions

Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 125) is authorized for direct deposit into the account shown below:

Checking

.

00

,

,

Savings

Routing number

Type

Account number

126 Direct deposit amount

The remaining amount of my refund (line 125) is authorized for direct deposit into the account shown below:

Checking

.

00

,

,

Savings

Routing number

Type

Account number

127 Direct deposit amount

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to

ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

Your signature

Date

Spouse’s/RDP’s signature (if a joint tax return, both must sign)

X

X

Your email address. Enter only one email address.

Preferred phone number

Sign

(

)

Here

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

I

t is unlawful to

forge a

spouse’s/RDP’s

Firm’s name (or yours, if self-employed)

PTIN

signature.

Joint tax return?

(See instructions)

Firm’s address

FEIN

Do you want to allow another person to discuss this tax return with us? See instructions. . . . .

Yes

No

Print Third Party Designee’s Name

Telephone Number

(

)

3143163

Short Form 540NR C1 2016 Side 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3