Form Tc 203 - Income And Expense Schedule For Cooperative And Condominium Property

ADVERTISEMENT

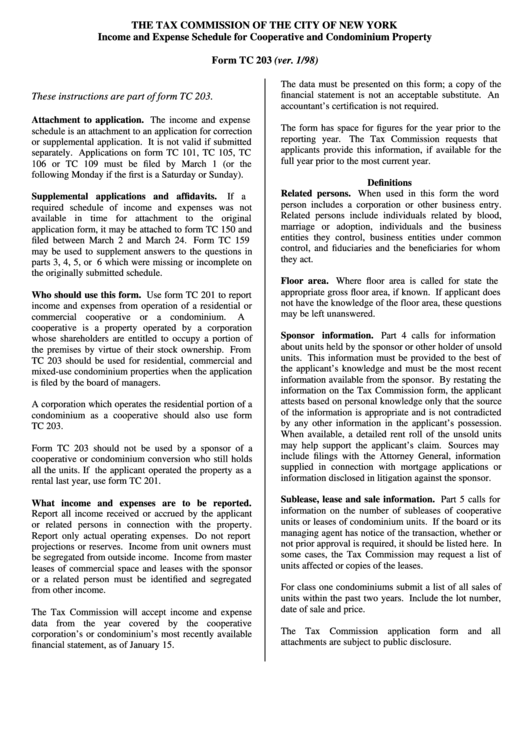

THE TAX COMMISSION OF THE CITY OF NEW YORK

Income and Expense Schedule for Cooperative and Condominium Property

Form TC 203 (ver. 1/98)

The data must be presented on this form; a copy of the

financial statement is not an acceptable substitute. An

These instructions are part of form TC 203.

accountant’s certification is not required.

Attachment to application. The income and expense

The form has space for figures for the year prior to the

schedule is an attachment to an application for correction

reporting year.

The Tax Commission requests that

or supplemental application. It is not valid if submitted

applicants provide this information, if available for the

separately. Applications on form TC 101, TC 105, TC

full year prior to the most current year.

106 or TC 109 must be filed by March 1 (or the

following Monday if the first is a Saturday or Sunday).

Definitions

Related persons. When used in this form the word

Supplemental applications and affidavits.

If a

person includes a corporation or other business entry.

required schedule of income and expenses was not

Related persons include individuals related by blood,

available in time for attachment to the original

marriage or adoption, individuals and the business

application form, it may be attached to form TC 150 and

entities they control, business entities under common

filed between March 2 and March 24. Form TC 159

control, and fiduciaries and the beneficiaries for whom

may be used to supplement answers to the questions in

they act.

parts 3, 4, 5, or 6 which were missing or incomplete on

the originally submitted schedule.

Floor area. Where floor area is called for state the

appropriate gross floor area, if known. If applicant does

Who should use this form. Use form TC 201 to report

not have the knowledge of the floor area, these questions

income and expenses from operation of a residential or

may be left unanswered.

commercial cooperative or a condominium.

A

cooperative is a property operated by a corporation

Sponsor information.

Part 4 calls for information

whose shareholders are entitled to occupy a portion of

about units held by the sponsor or other holder of unsold

the premises by virtue of their stock ownership. From

units. This information must be provided to the best of

TC 203 should be used for residential, commercial and

the applicant’s knowledge and must be the most recent

mixed-use condominium properties when the application

information available from the sponsor. By restating the

is filed by the board of managers.

information on the Tax Commission form, the applicant

attests based on personal knowledge only that the source

A corporation which operates the residential portion of a

of the information is appropriate and is not contradicted

condominium as a cooperative should also use form

by any other information in the applicant’s possession.

TC 203.

When available, a detailed rent roll of the unsold units

may help support the applicant’s claim. Sources may

Form TC 203 should not be used by a sponsor of a

include filings with the Attorney General, information

cooperative or condominium conversion who still holds

supplied in connection with mortgage applications or

all the units. If the applicant operated the property as a

information disclosed in litigation against the sponsor.

rental last year, use form TC 201.

Sublease, lease and sale information. Part 5 calls for

What income and expenses are to be reported.

information on the number of subleases of cooperative

Report all income received or accrued by the applicant

units or leases of condominium units. If the board or its

or related persons in connection with the property.

managing agent has notice of the transaction, whether or

Report only actual operating expenses. Do not report

not prior approval is required, it should be listed here. In

projections or reserves. Income from unit owners must

some cases, the Tax Commission may request a list of

be segregated from outside income. Income from master

units affected or copies of the leases.

leases of commercial space and leases with the sponsor

or a related person must be identified and segregated

For class one condominiums submit a list of all sales of

from other income.

units within the past two years. Include the lot number,

date of sale and price.

The Tax Commission will accept income and expense

data from the year covered by the cooperative

The Tax Commission application form and all

corporation’s or condominium’s most recently available

attachments are subject to public disclosure.

financial statement, as of January 15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1