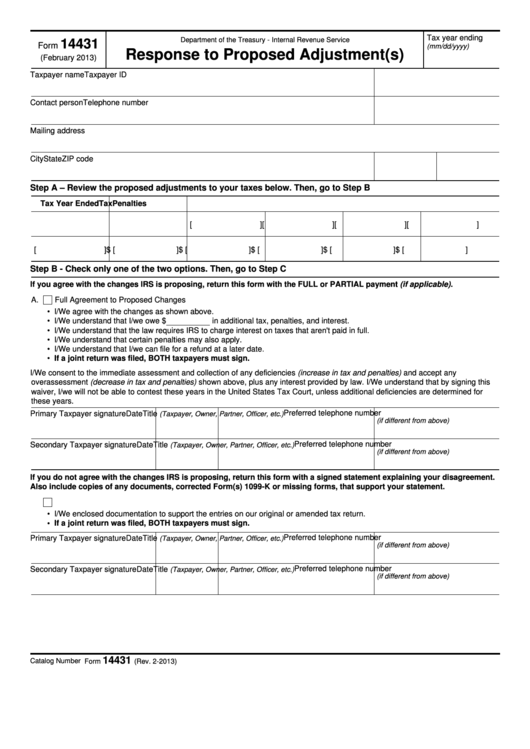

Tax year ending

Department of the Treasury - Internal Revenue Service

14431

Form

(mm/dd/yyyy)

Response to Proposed Adjustment(s)

(February 2013)

Taxpayer name

Taxpayer ID

Contact person

Telephone number

Mailing address

City

State

ZIP code

Step A – Review the proposed adjustments to your taxes below. Then, go to Step B

Tax Year Ended

Tax

Penalties

[

] [

] [

] [

]

[

] $ [

] $ [

] $ [

] $ [

] $ [

]

Step B - Check only one of the two options. Then, go to Step C

If you agree with the changes IRS is proposing, return this form with the FULL or PARTIAL payment (if applicable).

A.

Full Agreement to Proposed Changes

• I/We agree with the changes as shown above.

• I/We understand that I/we owe $

in additional tax, penalties, and interest.

• I/We understand that the law requires IRS to charge interest on taxes that aren't paid in full.

• I/We understand that certain penalties may also apply.

• I/We understand that I/we can file for a refund at a later date.

• If a joint return was filed, BOTH taxpayers must sign.

I/We consent to the immediate assessment and collection of any deficiencies (increase in tax and penalties) and accept any

overassessment (decrease in tax and penalties) shown above, plus any interest provided by law. I/We understand that by signing this

waiver, I/we will not be able to contest these years in the United States Tax Court, unless additional deficiencies are determined for

these years.

Preferred telephone number

Primary Taxpayer signature

Date

Title

(Taxpayer, Owner, Partner, Officer, etc.)

(if different from above)

Preferred telephone number

Secondary Taxpayer signature

Date

Title

(Taxpayer, Owner, Partner, Officer, etc.)

(if different from above)

If you do not agree with the changes IRS is proposing, return this form with a signed statement explaining your disagreement.

Also include copies of any documents, corrected Form(s) 1099-K or missing forms, that support your statement.

B.

Do Not Agree with Some of the Changes or All of the Changes

• I/We enclosed documentation to support the entries on our original or amended tax return.

• If a joint return was filed, BOTH taxpayers must sign.

Preferred telephone number

Primary Taxpayer signature

Date

Title

(Taxpayer, Owner, Partner, Officer, etc.)

(if different from above)

Preferred telephone number

Secondary Taxpayer signature

Date

Title

(Taxpayer, Owner, Partner, Officer, etc.)

(if different from above)

14431

Catalog Number 60746H

Form

(Rev. 2-2013)

1

1 2

2