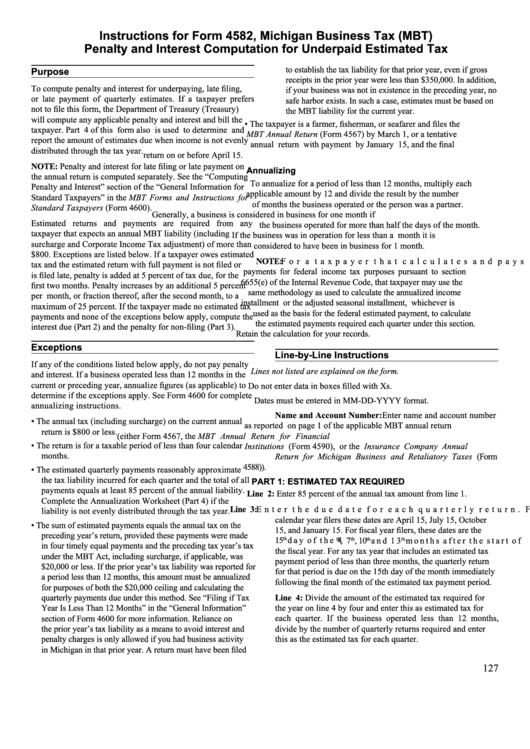

Instructions For Form 4582, Michigan Business Tax (Mbt) Penalty And Interest Computation For Underpaid Estimated Tax

ADVERTISEMENT

Instructions for Form 4582, Michigan Business Tax (MBT)

Penalty and Interest Computation for Underpaid Estimated Tax

to establish the tax liability for that prior year, even if gross

Purpose

receipts in the prior year were less than $350,000. In addition,

To compute penalty and interest for underpaying, late filing,

if your business was not in existence in the preceding year, no

or late payment of quarterly estimates. If a taxpayer prefers

safe harbor exists. In such a case, estimates must be based on

not to file this form, the Department of Treasury (Treasury)

the MBT liability for the current year.

will compute any applicable penalty and interest and bill the

• The taxpayer is a farmer, fisherman, or seafarer and files the

taxpayer. Part 4 of this form also is used to determine and

MBT Annual Return (Form 4567) by March 1, or a tentative

report the amount of estimates due when income is not evenly

annual return with payment by January 15, and the final

distributed through the tax year.

return on or before April 15.

Note: Penalty and interest for late filing or late payment on

Annualizing

the annual return is computed separately. See the “Computing

To annualize for a period of less than 12 months, multiply each

Penalty and Interest” section of the “General Information for

applicable amount by 12 and divide the result by the number

Standard Taxpayers” in the MBT Forms and Instructions for

of months the business operated or the person was a partner.

Standard Taxpayers (Form 4600).

Generally, a business is considered in business for one month if

Estimated returns and payments are required from any

the business operated for more than half the days of the month.

taxpayer that expects an annual MBT liability (including

If the business was in operation for less than a month it is

surcharge and Corporate Income Tax adjustment) of more than

considered to have been in business for 1 month.

$800. Exceptions are listed below. If a taxpayer owes estimated

Note: For a taxpayer that calculates and pays estimated

tax and the estimated return with full payment is not filed or

payments for federal income tax purposes pursuant to section

is filed late, penalty is added at 5 percent of tax due, for the

6655(e) of the Internal Revenue Code, that taxpayer may use the

first two months. Penalty increases by an additional 5 percent

same methodology as used to calculate the annualized income

per month, or fraction thereof, after the second month, to a

installment or the adjusted seasonal installment, whichever is

maximum of 25 percent. If the taxpayer made no estimated tax

used as the basis for the federal estimated payment, to calculate

payments and none of the exceptions below apply, compute the

the estimated payments required each quarter under this section.

interest due (Part 2) and the penalty for non-filing (Part 3).

Retain the calculation for your records.

Exceptions

Line-by-Line Instructions

If any of the conditions listed below apply, do not pay penalty

Lines not listed are explained on the form.

and interest. If a business operated less than 12 months in the

current or preceding year, annualize figures (as applicable) to

Do not enter data in boxes filled with Xs.

determine if the exceptions apply. See Form 4600 for complete

Dates must be entered in MM-DD-YYYY format.

annualizing instructions.

Name and Account Number: Enter name and account number

• The annual tax (including surcharge) on the current annual

as reported on page 1 of the applicable MBT annual return

return is $800 or less.

(either Form 4567, the MBT Annual Return for Financial

• The return is for a taxable period of less than four calendar

Institutions (Form 4590), or the Insurance Company Annual

months.

Return for Michigan Business and Retaliatory Taxes (Form

4588)).

• The estimated quarterly payments reasonably approximate

the tax liability incurred for each quarter and the total of all

PART 1: ESTIMATED TAX REQUIRED

payments equals at least 85 percent of the annual liability.

Line 2: Enter 85 percent of the annual tax amount from line 1.

Complete the Annualization Worksheet (Part 4) if the

Line 3: Enter the due date for each quarterly return. For

liability is not evenly distributed through the tax year.

calendar year filers these dates are April 15, July 15, October

• The sum of estimated payments equals the annual tax on the

15, and January 15. For fiscal year filers, these dates are the

preceding year’s return, provided these payments were made

15

day of the 4

, 7

, 10

and 13

months after the start of

th

th

th

th

th

in four timely equal payments and the preceding tax year’s tax

the fiscal year. For any tax year that includes an estimated tax

under the MBT Act, including surcharge, if applicable, was

payment period of less than three months, the quarterly return

$20,000 or less. If the prior year’s tax liability was reported for

for that period is due on the 15th day of the month immediately

a period less than 12 months, this amount must be annualized

following the final month of the estimated tax payment period.

for purposes of both the $20,000 ceiling and calculating the

quarterly payments due under this method. See “Filing if Tax

Line 4: Divide the amount of the estimated tax required for

Year Is Less Than 12 Months” in the “General Information”

the year on line 4 by four and enter this as estimated tax for

each quarter. If the business operated less than 12 months,

section of Form 4600 for more information. Reliance on

the prior year’s tax liability as a means to avoid interest and

divide by the number of quarterly returns required and enter

penalty charges is only allowed if you had business activity

this as the estimated tax for each quarter.

in Michigan in that prior year. A return must have been filed

127

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3