Git-10, Step-By-Step Guide To Form Nj-1040

ADVERTISEMENT

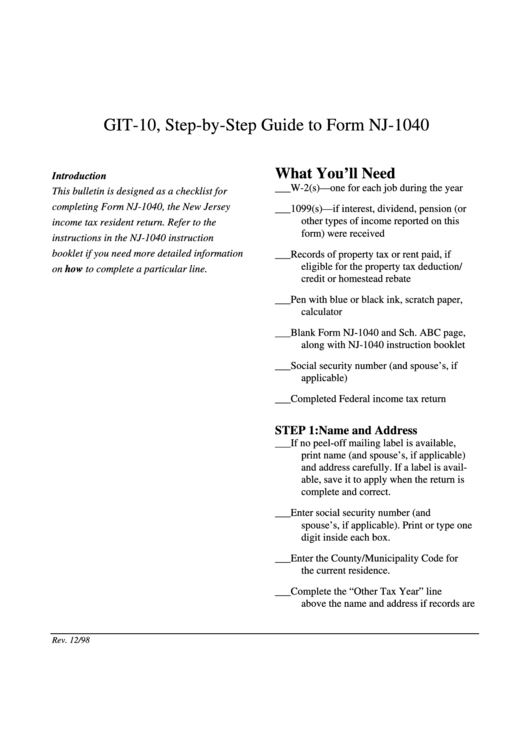

GIT-10, Step-by-Step Guide to Form NJ-1040

What You’ll Need

Introduction

___ W-2(s)—one for each job during the year

This bulletin is designed as a checklist for

completing Form NJ-1040, the New Jersey

___ 1099(s)—if interest, dividend, pension (or

other types of income reported on this

income tax resident return. Refer to the

form) were received

instructions in the NJ-1040 instruction

booklet if you need more detailed information

___ Records of property tax or rent paid, if

eligible for the property tax deduction/

on how to complete a particular line.

credit or homestead rebate

___ Pen with blue or black ink, scratch paper,

calculator

___ Blank Form NJ-1040 and Sch. ABC page,

along with NJ-1040 instruction booklet

___ Social security number (and spouse’s, if

applicable)

___ Completed Federal income tax return

STEP 1: Name and Address

___ If no peel-off mailing label is available,

print name (and spouse’s, if applicable)

and address carefully. If a label is avail-

able, save it to apply when the return is

complete and correct.

___ Enter social security number (and

spouse’s, if applicable). Print or type one

digit inside each box.

___ Enter the County/Municipality Code for

the current residence.

___ Complete the “Other Tax Year” line

above the name and address if records are

Rev. 12/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8