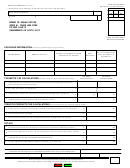

FORM M-19 (REV. 2011)

PAGE 2

Name

Cigarette Tax and Tobacco Tax License Number

Month Ending

__ __ / __ __

(MM/YY)

PART I - LIST OF NON-TAXABLE SALES

NON-TAXABLE SALES OF TOBACCO PRODUCTS, LARGE CIGARS, AND LITTLE CIGARS:

(1) Sales to the United States, including any agency or instrumentality thereof; or

(2) Sales that are shipped to a point outside the State for subsequent sale or use outside the State,

including sales made under section 212-8, HRS, to any common carrier for consumption out-of-

MCF112

state by the crew or passengers on such carrier; and sales by wholesalers from U.S. licensed

bonded warehouses to foreign fishing vessels and to common carriers for out-of-state consumption

by the crew or passengers.

TOBACCO PRODUCTS (Attach a separate schedule if more space is needed.)

Exempt Category

Name of Purchasers

Wholesale Value

Indicate as (1) or (2)

$

TOTAL (Enter total here and on page 1, line 5)

$

LARGE CIGARS (Attach a separate schedule if more space is needed.)

Exempt Category

Name of Purchasers

Wholesale Value

Indicate as (1) or (2)

$

TOTAL (Enter total here and on page 1, line 12)

$

LITTLE CIGARS (Attach a separate schedule if more space is needed.)

Exempt Category

Number of

Name of Purchasers

Wholesale Value

Indicate as (1) or (2)

Little Cigars

$

TOTAL (Enter totals here. Also enter total number

$

of little cigars on page 1, line 19)

NON-TAXABLE SALES OF CIGARETTES (Attach a separate schedule if more space is needed.):

Sales to the United States, including any agency or instrumentality thereof.

Note: Do not include in this list, sales of cigarettes that are shipped to a point outside the State for subsequent sale or use outside the State, including

sales made under section 212-8, HRS, to any common carrier for consumption out-of-state by the crew or passengers on such carrier; and sales

by wholesalers from U.S. licensed bonded warehouses to foreign fishing vessels and to common carriers for out-of-state consumption by the crew

or passengers. These sales should be listed on page 3, Part II, Refund of Cigarette Tax Paid With Cigarette Tax Stamps.

Number of

Name of Purchasers

Wholesale Value

Cigarettes

$

TOTAL (Enter totals here. Also enter total number

$

of cigarettes on page 4, Part IV, line 5)

1

1 2

2 3

3 4

4