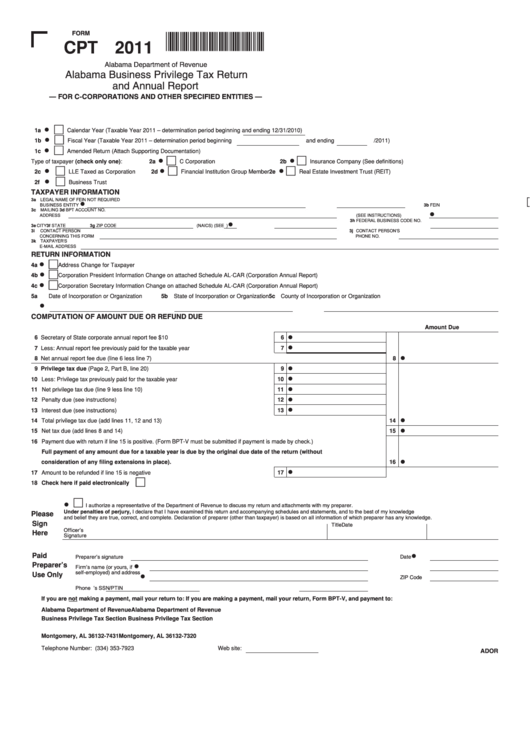

Form Cpt - Alabama Business Privilege Tax Return And Annual Report - 2011

ADVERTISEMENT

FORM

111001CP

CPT 2011

Alabama Department of Revenue

Alabama Business Privilege Tax Return

and Annual Report

— FOR C-CORPORATIONS AND OTHER SPECIFIED ENTITIES —

•

1a

Calendar Year (Taxable Year 2011 – determination period beginning

and ending 12/31/2010)

•

1b

Fiscal Year (Taxable Year 2011 – determination period beginning

and ending

/2011)

•

1c

Amended Return (Attach Supporting Documentation)

•

•

Type of taxpayer (check only one):

2a

C Corporation

2b

Insurance Company (See definitions)

•

•

•

2c

LLE Taxed as Corporation

2d

Financial Institution Group Member

2e

Real Estate Investment Trust (REIT)

•

2f

Business Trust

TAXPAYER INFORMATION

3a LEGAL NAME OF

FEIN NOT REQUIRED

•

BUSINESS ENTITY

3b FEIN

(SEE INSTRUCTIONS)

3c MAILING

3d BPT ACCOUNT NO.

•

ADDRESS

(SEE INSTRUCTIONS)

3h FEDERAL BUSINESS CODE NO.

•

3e CITY

3f STATE

3g ZIP CODE

(NAICS) (SEE )

3i

CONTACT PERSON

3j CONTACT PERSON’S

CONCERNING THIS FORM

PHONE NO.

3k TAXPAYER’S

E-MAIL ADDRESS

RETURN INFORMATION

•

4a

Address Change for Taxpayer

•

4b

Corporation President Information Change on attached Schedule AL-CAR (Corporation Annual Report)

•

4c

Corporation Secretary Information Change on attached Schedule AL-CAR (Corporation Annual Report)

5a

Date of Incorporation or Organization

5b State of Incorporation or Organization

5c County of Incorporation or Organization

•

COMPUTATION OF AMOUNT DUE OR REFUND DUE

Amount Due

•

6 Secretary of State corporate annual report fee $10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

•

7 Less: Annual report fee previously paid for the taxable year . . . . . . . . . . . . . . . . . . . . . . . .

7

•

8 Net annual report fee due (line 6 less line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

•

9 Privilege tax due (Page 2, Part B, line 20). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

•

10 Less: Privilege tax previously paid for the taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

•

11 Net privilege tax due (line 9 less line 10). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

•

12 Penalty due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

•

13 Interest due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

•

14 Total privilege tax due (add lines 11, 12 and 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

•

15 Net tax due (add lines 8 and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Payment due with return if line 15 is positive. (Form BPT-V must be submitted if payment is made by check.)

Full payment of any amount due for a taxable year is due by the original due date of the return (without

•

consideration of any filing extensions in place). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

•

17 Amount to be refunded if line 15 is negative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Check here if paid electronically

•

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

Please

and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Title

Date

Officer’s

Here

Signature

Paid

•

Date

Preparer’s signature

Preparer’s

•

Firm’s name (or yours, if

E.I. No.

Use Only

self-employed) and address

•

ZIP Code

Phone No.

Preparer’s SSN/PTIN

If you are not making a payment, mail your return to:

If you are making a payment, mail your return, Form BPT-V, and payment to:

Alabama Department of Revenue

Alabama Department of Revenue

Business Privilege Tax Section

Business Privilege Tax Section

P.O. Box 327431

P.O. Box 327320

Montgomery, AL 36132-7431

Montgomery, AL 36132-7320

Telephone Number: (334) 353-7923

Web site:

ADOR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2