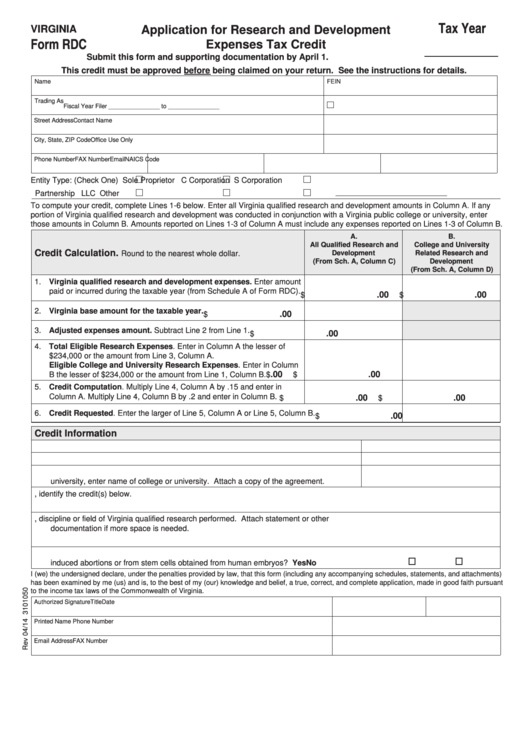

Tax Year

VIRGINIA

Application for Research and Development

Form RDC

Expenses Tax Credit

___________

Submit this form and supporting documentation by April 1.

This credit must be approved before being claimed on your return. See the instructions for details.

Name

FEIN

Trading As

Fiscal Year Filer _______________ to _______________

Street Address

Contact Name

City, State, ZIP Code

Office Use Only

Phone Number

FAX Number

Email

NAICS Code

Entity Type: (Check One)

Sole Proprietor

C Corporation

S Corporation

Partnership

LLC

Other

To compute your credit, complete Lines 1-6 below. Enter all Virginia qualified research and development amounts in Column A. If any

portion of Virginia qualified research and development was conducted in conjunction with a Virginia public college or university, enter

those amounts in Column B. Amounts reported on Lines 1-3 of Column A must include any expenses reported on Lines 1-3 of Column B.

A.

B.

All Qualified Research and

College and University

Credit Calculation.

Development

Related Research and

Round to the nearest whole dollar.

(From Sch. A, Column C)

Development

(From Sch. A, Column D)

1. Virginia qualified research and development expenses. Enter amount

paid or incurred during the taxable year (from Schedule A of Form RDC).

.00

.00

$

$

2. Virginia base amount for the taxable year.

.00

$

3. Adjusted expenses amount. Subtract Line 2 from Line 1.

.00

$

4. Total Eligible Research Expenses. Enter in Column A the lesser of

$234,000 or the amount from Line 3, Column A.

Eligible College and University Research Expenses. Enter in Column

.00

.00

B the lesser of $234,000 or the amount from Line 1, Column B.

$

$

5. Credit Computation. Multiply Line 4, Column A by .15 and enter in

Column A. Multiply Line 4, Column B by .2 and enter in Column B.

.00

.00

$

$

6. Credit Requested. Enter the larger of Line 5, Column A or Line 5, Column B.

.00

$

Credit Information

1.

Number of full time employees during the year for which the credit is sought.

2.

Total gross receipts or anticipated gross receipts for the taxable year the credit is sought.

3.

If research was conducted in conjunction with a Virginia public or private college or

university, enter name of college or university. Attach a copy of the agreement.

4.

If you applied for any other credits this year, identify the credit(s) below.

5.

Provide a brief description of the area, discipline or field of Virginia qualified research performed. Attach statement or other

documentation if more space is needed.

6.

Do you conduct research and development in Virginia on human cells or tissue derived from

induced abortions or from stem cells obtained from human embryos?

Yes

No

I (we) the undersigned declare, under the penalties provided by law, that this form (including any accompanying schedules, statements, and attachments)

has been examined by me (us) and is, to the best of my (our) knowledge and belief, a true, correct, and complete application, made in good faith pursuant

to the income tax laws of the Commonwealth of Virginia.

Authorized Signature

Title

Date

Printed Name

Phone Number

Email Address

FAX Number

1

1 2

2 3

3 4

4 5

5 6

6