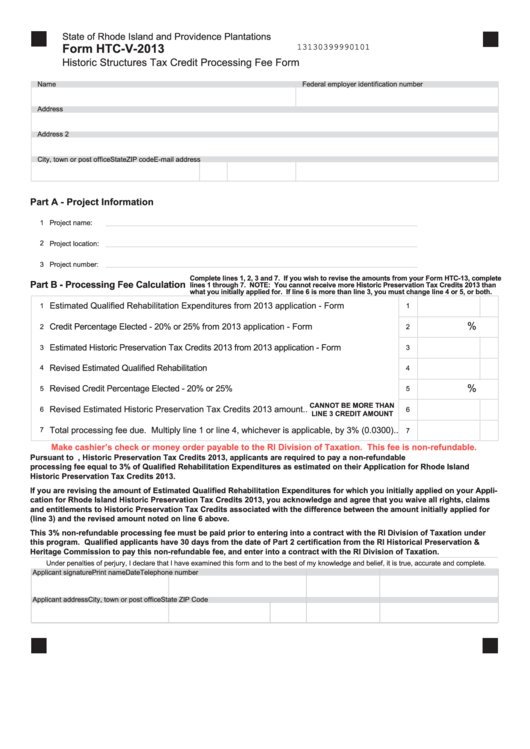

State of Rhode Island and Providence Plantations

Form HTC-V-2013

13130399990101

Historic Structures Tax Credit Processing Fee Form

Name

Federal employer identification number

Address

Address 2

City, town or post office

State

ZIP code

E-mail address

Part A - Project Information

1

Project name:

2

Project location:

3

Project number:

Complete lines 1, 2, 3 and 7. If you wish to revise the amounts from your Form HTC-13, complete

Part B - Processing Fee Calculation

lines 1 through 7. NOTE: You cannot receive more Historic Preservation Tax Credits 2013 than

what you initially applied for. If line 6 is more than line 3, you must change line 4 or 5, or both.

Estimated Qualified Rehabilitation Expenditures from 2013 application - Form HTC-13........

1

1

%

Credit Percentage Elected - 20% or 25% from 2013 application - Form HTC-13.....................

2

2

Estimated Historic Preservation Tax Credits 2013 from 2013 application - Form HTC-13...........

3

Revised Estimated Qualified Rehabilitation Expenditures.............................................................

4

4

%

Revised Credit Percentage Elected - 20% or 25%........................................................................

5

CANNOT BE MORE THAN

Revised Estimated Historic Preservation Tax Credits 2013 amount..

6

6

LINE 3 CREDIT AMOUNT

Total processing fee due. Multiply line 1 or line 4, whichever is applicable, by 3% (0.0300)..

7

7

Make cashier’s check or money order payable to the RI Division of Taxation. This fee is non-refundable.

Pursuant to R.I.G.L. 44-33.6, Historic Preservation Tax Credits 2013, applicants are required to pay a non-refundable

processing fee equal to 3% of Qualified Rehabilitation Expenditures as estimated on their Application for Rhode Island

Historic Preservation Tax Credits 2013.

If you are revising the amount of Estimated Qualified Rehabilitation Expenditures for which you initially applied on your Appli-

cation for Rhode Island Historic Preservation Tax Credits 2013, you acknowledge and agree that you waive all rights, claims

and entitlements to Historic Preservation Tax Credits associated with the difference between the amount initially applied for

(line 3) and the revised amount noted on line 6 above.

This 3% non-refundable processing fee must be paid prior to entering into a contract with the RI Division of Taxation under

this program. Qualified applicants have 30 days from the date of Part 2 certification from the RI Historical Preservation &

Heritage Commission to pay this non-refundable fee, and enter into a contract with the RI Division of Taxation.

Under penalties of perjury, I declare that I have examined this form and to the best of my knowledge and belief, it is true, accurate and complete.

Applicant signature

Print name

Date

Telephone number

Applicant address

City, town or post office

State

ZIP Code

1

1