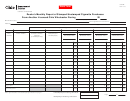

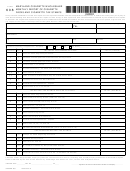

MARYLAND CIgARETTE WHOLESALER

FORM

608

MONTHLY REPORT OF CIgARETTE PACKS AND

CIgARETTE TAX STAMPS INSTRUCTIONS

general:

Section: UNAFFIXED MARYLAND TAX STAMPS

Line 21 Enter inventory figure from line 25 of the previous

List the License Number, complete Name and Address of

Distributor on this form and all corresponding schedules.

monthly report’s Physical Inventory -On Hand end of

month

Report Cigarette packs in the period or month they physically

arrive or leave the premises.

Line 22 Enter the total quantity of Maryland Cigarette Tax

Stamps received during the month.

Report on a separate Form 608 different quantities of cigarettes

per pack.

Line 23 Enter Total of lines 21 and 22.

Line 24 Enter Total of all credits issued by a Maryland State

Indicate on front of Form 608, by circling, the quantity for

which the report is made. Computer Print-Outs of Schedules,

Auditor during the month.

submitted in the same format, may be substituted upon prior

Line 25 Enter physical inventory figure taken from the Form

approval from this Office.

602 ATTD.

Section: WITHOUT TAX STAMPS AFFIXED

Line 26 Total lines 24 and 25 subtract this figure from the

Line 1

Enter inventory figure from line 5 of the previous

total on line 23, the resulting figure is the number of

monthly report’s Physical Inventory -On Hand end of

stamps affixed to packs for the month. This number is

month.

also to be used on line 12 of this report.

Line 2

Enter total of the Schedule A’s submitted with this

report.

For more information:

Line 3

Enter total of column marked Without Tax Stamps

Comptroller of Maryland

Affixed from the Schedule B.

Revenue Administration Division

Line 4

Enter -Total of lines 1,2, and 3.

P.O. Box 2999

Annapolis, MD 21404-2999

Line 5

Enter physical inventory figure taken from the Form

602 ATTD.

Telephone: 410-260-7980, 800-638-2937

Fax: 410-260-7924

Line 6

Enter total of the Schedule C-2 submitted with this

report.

Line 7

Enter total of the Schedule C-3 submitted with this

Please submit the completed original and two (2) copies

report.

to the address above.

Line 8

Enter total of column marked Without Tax Stamps

Affixed from the Schedule D.

Line 9

Enter total of column marked Without Tax Stamps

Affixed from the Schedule E. Attach any supporting

documents for these transactions to the Schedule E.

Line 10 Enter Total of lines 5, 6, 7, 8, and 9.

Section: MARYLAND TAX STAMPS AFFIXED TO PACKS

Line 11 Enter inventory figure from line 15 of the previous

monthly report’s Physical Inventory -On Hand end of

month.

Line 12 Enter figure generated by the subtraction on line 26 of

this report.

Line 13 Enter the total of the column marked Maryland Tax

Stamps Affixed from the Schedule B.

Line 14 Enter Total of lines 11, 12, and 13.

Line 15 Enter physical inventory figure taken from the Form

602 ATTD.

Line 16 Enter total Maryland stamped packs sold during this

month or period.

Line 17 Enter total of the column marked Maryland Tax

Stamps Affixed from the Schedule D.

Line 18 Enter total of the column marked Maryland Tax

Stamps Affixed from the Schedule E submitted with

this report. Attach any supporting documents for

these transactions to the Schedule E.

Line 19 Enter Total of lines 15, 16, 17, and 18. Line 20 Subtract

line 19 from line 14 the difference is considered

Unaccountable. This is simply a balancing line, to

allow and insure use of accurate figures; eliminating

the necessity to force figures to balance.

COM/RAD-608

Revised 02/13

1

1 2

2