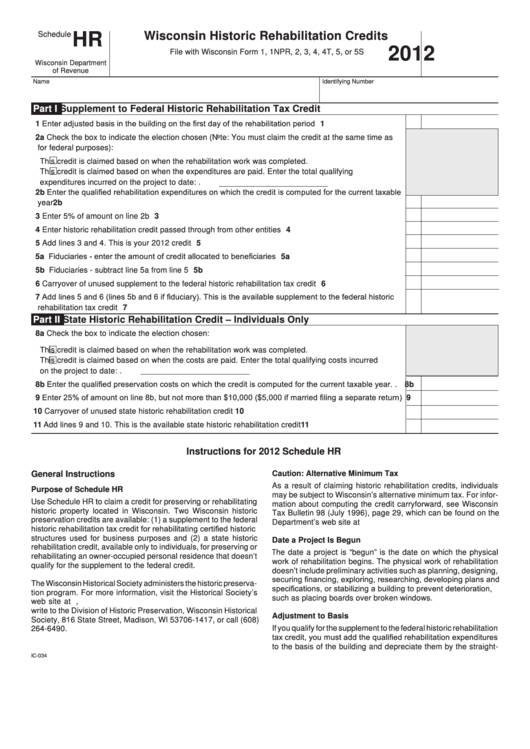

Schedule

Wisconsin Historic Rehabilitation Credits

HR

2012

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5, or 5S

Wisconsin Department

of Revenue

Name

Identifying Number

Part I

Supplement to Federal Historic Rehabilitation Tax Credit

Enter adjusted basis in the building on the first day of the rehabilitation period . . . . . . . . . . . . . . . . . .

1

1

2a Check the box to indicate the election chosen (Note: You must claim the credit at the same time as

for federal purposes):

This credit is claimed based on when the rehabilitation work was completed.

This credit is claimed based on when the expenditures are paid. Enter the total qualifying

expenditures incurred on the project to date:

.

2b Enter the qualified rehabilitation expenditures on which the credit is computed for the current taxable

year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2b

3

Enter 5% of amount on line 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Enter historic rehabilitation credit passed through from other entities . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Add lines 3 and 4. This is your 2012 credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5a

5b Fiduciaries - subtract line 5a from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5b

6

Carryover of unused supplement to the federal historic rehabilitation tax credit . . . . . . . . . . . . . . . . . .

6

Add lines 5 and 6 (lines 5b and 6 if fiduciary). This is the available supplement to the federal historic

7

rehabilitation tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Part II

State Historic Rehabilitation Credit – Individuals Only

8a Check the box to indicate the election chosen:

This credit is claimed based on when the rehabilitation work was completed.

This credit is claimed based on when the costs are paid. Enter the total qualifying costs incurred

on the project to date:

.

8b Enter the qualified preservation costs on which the credit is computed for the current taxable year . .

8b

Enter 25% of amount on line 8b, but not more than $10,000 ($5,000 if married filing a separate return) 9

9

10

Carryover of unused state historic rehabilitation credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Add lines 9 and 10. This is the available state historic rehabilitation credit . . . . . . . . . . . . . . . . . . . . . 11

Instructions for 2012 Schedule HR

General Instructions

Caution: Alternative Minimum Tax

As a result of claiming historic rehabilitation credits, individuals

Purpose of Schedule HR

may be subject to Wisconsin’s alternative minimum tax. For infor-

Use Schedule HR to claim a credit for preserving or rehabilitating

mation about computing the credit carryforward, see Wisconsin

historic property located in Wisconsin. Two Wisconsin historic

Tax Bulletin 98 (July 1996), page 29, which can be found on the

preservation credits are available: (1) a supplement to the federal

Department’s web site at

historic rehabilitation tax credit for rehabilitating certified historic

structures used for business purposes and (2) a state historic

Date a Project Is Begun

rehabilitation credit, available only to individuals, for preserving or

The date a project is “begun” is the date on which the physical

rehabilitating an owner-occupied personal residence that doesn’t

work of rehabilitation begins. The physical work of rehabilitation

qualify for the supplement to the federal credit.

doesn’t include preliminary activities such as planning, designing,

securing financing, exploring, researching, developing plans and

The Wisconsin Historical Society administers the historic preserva-

specifications, or stabilizing a building to prevent deterioration,

tion program. For more information, visit the Historical Society’s

such as placing boards over broken windows.

web site at ,

write to the Division of Historic Preservation, Wisconsin Historical

Adjustment to Basis

Society, 816 State Street, Madison, WI 53706-1417, or call (608)

If you qualify for the supplement to the federal historic rehabilitation

264-6490.

tax credit, you must add the qualified rehabilitation expenditures

to the basis of the building and depreciate them by the straight-

IC-034

1

1 2

2 3

3