Form Wv/nrw-3 - Information Report Of 761 Nonpartnership Ventures

ADVERTISEMENT

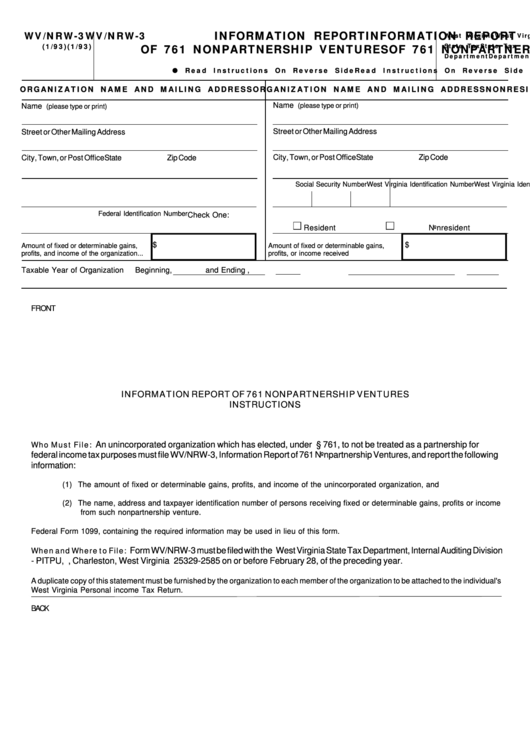

INFORMATION REPORT

INFORMATION REPORT

WV/NRW-3

WV/NRW-3

West Virginia

West Virginia

OF 761 NONPARTNERSHIP VENTURES

OF 761 NONPARTNERSHIP VENTURES

( 1 / 9 3 )

( 1 / 9 3 )

State Tax

State Tax

Department

Department

R e a d I n s t r u c t i o n s O n R e v e r s e S i d e

R e a d I n s t r u c t i o n s O n R e v e r s e S i d e

ORGANIZATION NAME AND MAILING ADDRESS

ORGANIZATION NAME AND MAILING ADDRESS

NONRESIDENT'S NAME AND MAILING ADDRESS

NONRESIDENT'S NAME AND MAILING ADDRESS

Name

Name

(please type or print)

(please type or print)

Street or Other Mailing Address

Street or Other Mailing Address

City, Town, or Post Office

State

Zip Code

City, Town, or Post Office

State

Zip Code

West Virginia Identification Number

Social Security Number

West Virginia Identification Number

Federal Identification Number

Check One:

Resident

Nonresident

$

$

Amount of fixed or determinable gains,

Amount of fixed or determinable gains,

profits, and income of the organization ...

profits, or income received ......................

Taxable Year of Organization

Beginning

,

and Ending

,

FRONT

INFORMATION REPORT OF 761 NONPARTNERSHIP VENTURES

INSTRUCTIONS

Who Must File:

An unincorporated organization which has elected, under I.R.C. § 761, to not be treated as a partnership for

federal income tax purposes must file WV/NRW-3, Information Report of 761 Nonpartnership Ventures, and report the following

information:

(1) The amount of fixed or determinable gains, profits, and income of the unincorporated organization, and

(2) The name, address and taxpayer identification number of persons receiving fixed or determinable gains, profits or income

from such nonpartnership venture.

Federal Form 1099, containing the required information may be used in lieu of this form.

When and Where to File:

Form WV/NRW-3 must be filed with the West Virginia State Tax Department, Internal Auditing Division

- PITPU, P.O. Box 2585, Charleston, West Virginia 25329-2585 on or before February 28, of the preceding year.

A duplicate copy of this statement must be furnished by the organization to each member of the organization to be attached to the individual's

West Virginia Personal income Tax Return.

BACK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1