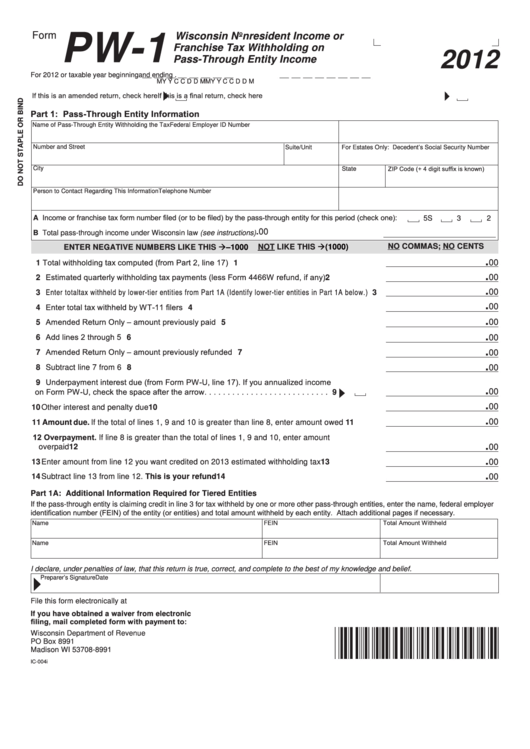

Form

Wisconsin Nonresident Income or

PW-1

Franchise Tax Withholding on

2012

Pass-Through Entity Income

For 2012 or taxable year beginning

and ending

.

M

M

D

D

C

C

Y

Y

M

M

D

D

C

C

Y

Y

If this is an amended return, check here

If this is a final return, check here

Part 1: Pass-Through Entity Information

Name of Pass-Through Entity Withholding the Tax

Federal Employer ID Number

Number and Street

For Estates Only: Decedent’s Social Security Number

Suite/Unit

ZIP Code (+ 4 digit suffix is known)

City

State

Person to Contact Regarding This Information

Telephone Number

A Income or franchise tax form number filed (or to be filed) by the pass-through entity for this period (check one):

5S

3

2

.00

B Total pass-through income under Wisconsin law (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1000)

–1000

NO COMMAS; NO CENTS

ENTER NEGATIVE NUMBERS LIKE THIS

NOT LIKE THIS

.

1 Total withholding tax computed (from Part 2, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

1

.

2 Estimated quarterly withholding tax payments (less Form 4466W refund, if any) . . . . . . . . .

00

2

.

3 Enter total tax withheld by lower-tier entities from Part 1A (Identify lower-tier entities in Part 1A below.) 3

00

.

4 Enter total tax withheld by WT-11 filers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

4

.

5 Amended Return Only – amount previously paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

5

.

6 Add lines 2 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

.

7 Amended Return Only – amount previously refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

.

00

8 Subtract line 7 from 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Underpayment interest due (from Form PW-U, line 17). If you annualized income

.

on Form PW-U, check the space after the arrow. . . . . . . . . . . . . . . . . . . . . . . . . . .

00

9

.

00

10 Other interest and penalty due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.

00

11 Amount due. If the total of lines 1, 9 and 10 is greater than line 8, enter amount owed . . . . 11

12 Overpayment. If line 8 is greater than the total of lines 1, 9 and 10, enter amount

.

overpaid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

00

.

13 Enter amount from line 12 you want credited on 2013 estimated withholding tax . . . . . . . . . 13

00

.

14 Subtract line 13 from line 12. This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

00

Part 1A: Additional Information Required for Tiered Entities

If the pass-through entity is claiming credit in line 3 for tax withheld by one or more other pass-through entities, enter the name, federal employer

identification number (FEIN) of the entity (or entities) and total amount withheld by each entity. Attach additional pages if necessary.

Total Amount Withheld

Name

FEIN

Total Amount Withheld

Name

FEIN

I declare, under penalties of law, that this return is true, correct, and complete to the best of my knowledge and belief.

Preparer’s Signature

Date

File this form electronically at or through the Federal/State E-Filing Program.

If you have obtained a waiver from electronic

filing, mail completed form with payment to:

Wisconsin Department of Revenue

PO Box 8991

Madison WI 53708-8991

IC-004i

1

1 2

2