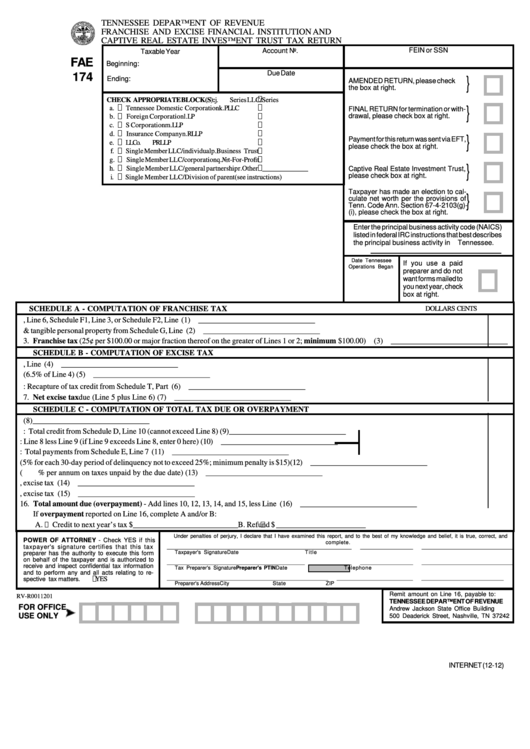

Form Fae 174 - Franchise And Excise Financial Institution And Captive Real Estate Investment Trust Tax Return

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

FRANCHISE AND EXCISE FINANCIAL INSTITUTION AND

CAPTIVE REAL ESTATE INVESTMENT TRUST TAX RETURN

Account No.

FEIN or SSN

Taxable Year

FAE

Beginning:

Due Date

174

Ending:

}

AMENDED RETURN, please check

the box at right.

CHECK APPROPRIATE BLOCK(S):

j.

Series LLC/Series

a.

Tennessee Domestic Corporation

k.

PLLC

}

FINAL RETURN for termination or with-

drawal, please check box at right.

b.

Foreign Corporation

l.

LP

c.

S Corporation

m.

LLP

d.

Insurance Company

n.

RLLP

}

Payment for this return was sent via EFT,

e.

LLC

o.

PRLLP

please check the box at right.

f.

Single Member LLC/individual

p.

Business Trust

g.

Single Member LLC/corporation

q.

Not-For-Profit

}

h.

Single Member LLC/general partnership

r.

Other _____________

Captive Real Estate Investment Trust,

please check box at right.

i.

Single Member LLC/Division of parent(see instructions)

Taxpayer has made an election to cal-

}

culate net worth per the provisions of

Tenn. Code Ann. Section 67-4-2103(g)-

(i), please check the box at right.

Enter the principal business activity code (NAICS)

listed in federal IRC instructions that best describes

the principal business activity in Tennessee.

Date Tennessee

If you use a paid

Operations Began

preparer and do not

want forms mailed to

you next year, check

box at right.

SCHEDULE A - COMPUTATION OF FRANCHISE TAX

DOLLARS CENTS

1. Total net worth from Schedule F, Line 6, Schedule F1, Line 3, or Schedule F2, Line 5 ............................................. (1) ______________________________

2. Total real & tangible personal property from Schedule G, Line 15 ........................................................................... (2) ______________________________

3. Franchise tax (25¢ per $100.00 or major fraction thereof on the greater of Lines 1 or 2; minimum $100.00) ....... (3) ______________________________

SCHEDULE B - COMPUTATION OF EXCISE TAX

4. Income subject to excise tax from Schedule J, Line 38 ............................................................................................. (4) ______________________________

5. Excise tax (6.5% of Line 4) ...................................................................................................................................... (5) ______________________________

6. Add: Recapture of tax credit from Schedule T, Part 2 .............................................................................................. (6) ______________________________

7. Net excise tax due (Line 5 plus Line 6) .................................................................................................................. (7) ______________________________

SCHEDULE C - COMPUTATION OF TOTAL TAX DUE OR OVERPAYMENT

8. Total Franchise and Excise taxes - Add lines 3 and 7 ...........................................................

(8) ______________________________

9. Deduct: Total credit from Schedule D, Line 10 (cannot exceed Line 8) ..............................

(9) ______________________________

10. Subtotal: Line 8 less Line 9 (if Line 9 exceeds Line 8, enter 0 here) .....................................

(10) ______________________________

11. Deduct: Total payments from Schedule E, Line 7 ................................................................

(11) ______________________________

12. Penalty (5% for each 30-day period of delinquency not to exceed 25%; minimum penalty is $15)

(12) ______________________________

13. Interest (

% per annum on taxes unpaid by the due date) ............................................................................... (13) ______________________________

14. Penalty on estimated franchise, excise tax payments ............................................................................................. (14) ______________________________

15. Interest on estimated franchise, excise tax payments ............................................................................................. (15) ______________________________

16. Total amount due (overpayment) - Add lines 10, 12, 13, 14, and 15, less Line 11 ............................................. (16) ______________________________

If overpayment reported on Line 16, complete A and/or B:

A.

Credit to next year’s tax $ ___________________________

B.

Refund $ _______________________

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and

POWER OF ATTORNEY - Check YES if this

complete.

taxpayer's signature certifies that this tax

_______________________________________________________________

__________________

_______________________________

Taxpayer's Signature

Date

Title

preparer has the authority to execute this form

on behalf of the taxpayer and is authorized to

_______________________________________________

_____________

__________________

_______________________________

receive and inspect confidential tax information

Tax Preparer's Signature

Preparer's PTIN

Date

Telephone

and to perform any and all acts relating to re-

_______________________________________________________

__________________________

________

____________________

spective tax matters.

YES

Preparer's Address

City

State

ZIP

Remit amount on Line 16, payable to:

RV-R0011201

TENNESSEE DEPARTMENT OF REVENUE

FOR OFFICE

Andrew Jackson State Office Building

USE ONLY

500 Deaderick Street, Nashville, TN 37242

INTERNET (12-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10