Reset

Print

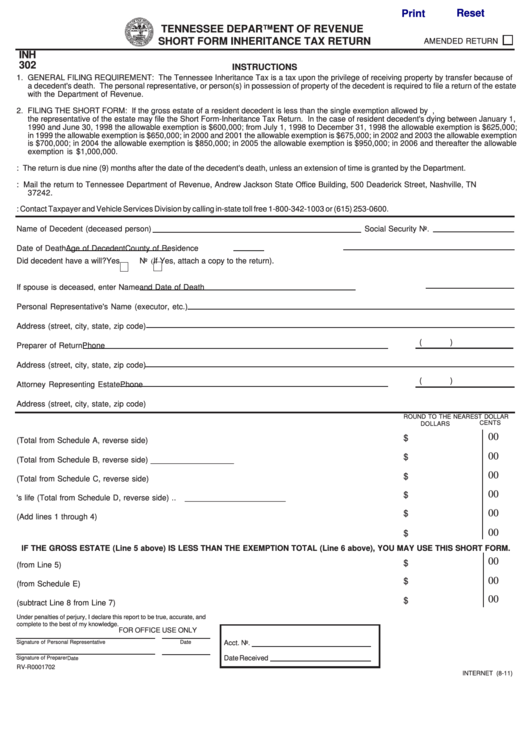

TENNESSEE DEPARTMENT OF REVENUE

SHORT FORM INHERITANCE TAX RETURN

AMENDED RETURN

INH

302

INSTRUCTIONS

1. GENERAL FILING REQUIREMENT: The Tennessee Inheritance Tax is a tax upon the privilege of receiving property by transfer because of

a decedent's death. The personal representative, or person(s) in possession of property of the decedent is required to file a return of the estate

with the Department of Revenue.

2. FILING THE SHORT FORM: If the gross estate of a resident decedent is less than the single exemption allowed by T.C.A. Section 67-8-316,

the representative of the estate may file the Short Form-Inheritance Tax Return. In the case of resident decedent's dying between January 1,

1990 and June 30, 1998 the allowable exemption is $600,000; from July 1, 1998 to December 31, 1998 the allowable exemption is $625,000;

in 1999 the allowable exemption is $650,000; in 2000 and 2001 the allowable exemption is $675,000; in 2002 and 2003 the allowable exemption

is $700,000; in 2004 the allowable exemption is $850,000; in 2005 the allowable exemption is $950,000; in 2006 and thereafter the allowable

exemption is $1,000,000.

3. DUE DATE: The return is due nine (9) months after the date of the decedent's death, unless an extension of time is granted by the Department.

4. FILING: Mail the return to Tennessee Department of Revenue, Andrew Jackson State Office Building, 500 Deaderick Street, Nashville, TN

37242.

5. FOR ASSISTANCE: Contact Taxpayer and Vehicle Services Division by calling in-state toll free 1-800-342-1003 or (615) 253-0600.

Name of Decedent (deceased person)

Social Security No.

Date of Death

Age of Decedent

County of Residence

Did decedent have a will?

Yes

No

If Yes, attach a copy to the return).

(

If spouse is deceased, enter Name

and Date of Death

Personal Representative's Name (executor, etc.)

Address (street, city, state, zip code)

(

)

Preparer of Return

Phone

Address (street, city, state, zip code)

(

)

Attorney Representing Estate

Phone

Address (street, city, state, zip code)

ROUND TO THE NEAREST DOLLAR

CENTS

DOLLARS

00

$

1. Real Estate (Total from Schedule A, reverse side) .........................................................................................

_______________________

00

$

2. Personal and Miscellaneous Property (Total from Schedule B, reverse side) ................................................

_______________________

00

$

3. Jointly-Owned Property (Total from Schedule C, reverse side) ......................................................................

_______________________

00

$

4. Transfers during decedent's life (Total from Schedule D, reverse side) .........................................................

_______________________

00

$

5. Total Gross Estate (Add lines 1 through 4) .....................................................................................................

_______________________

00

$

6. Allowable Exemption ........................................................................................................................................

_______________________

IF THE GROSS ESTATE (Line 5 above) IS LESS THAN THE EXEMPTION TOTAL (Line 6 above), YOU MAY USE THIS SHORT FORM.

00

$

7. TOTAL GROSS ESTATE (from Line 5) ...........................................................................................................

_______________________

00

$

8. TOTAL DEDUCTIONS (from Schedule E) ......................................................................................................

_______________________

00

$

9. NET ESTATE (subtract Line 8 from Line 7) ....................................................................................................

_______________________

Under penalties of perjury, I declare this report to be true, accurate, and

complete to the best of my knowledge.

FOR OFFICE USE ONLY

Signature of Personal Representative

Date

Acct. No.

Date Received

Signature of Preparer

Date

RV-R0001702

INTERNET (8-11)

1

1 2

2