Industrial Machinery Tax Credit

Download a blank fillable Industrial Machinery Tax Credit in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Industrial Machinery Tax Credit with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

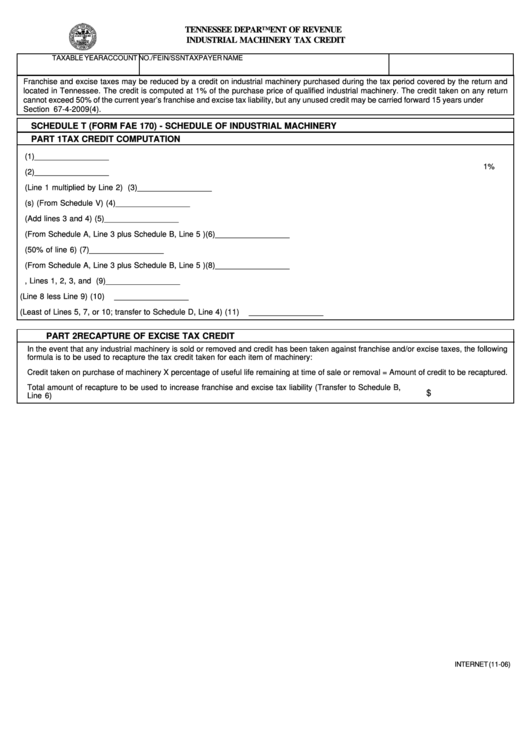

TENNESSEE DEPARTMENT OF REVENUE

INDUSTRIAL MACHINERY TAX CREDIT

TAXABLE YEAR

TAXPAYER NAME

ACCOUNT NO./FEIN/SSN

Franchise and excise taxes may be reduced by a credit on industrial machinery purchased during the tax period covered by the return and

located in Tennessee. The credit is computed at 1% of the purchase price of qualified industrial machinery. The credit taken on any return

cannot exceed 50% of the current year’s franchise and excise tax liability, but any unused credit may be carried forward 15 years under T.C.A.

Section 67-4-2009(4).

SCHEDULE T (FORM FAE 170) - SCHEDULE OF INDUSTRIAL MACHINERY

PART 1

TAX CREDIT COMPUTATION

1. Purchase price of machinery ....................................................................................................................... (1)

_________________

1%

2. Percentage allowed ...................................................................................................................................... (2)

_________________

3. Original credit (Line 1 multiplied by Line 2) ................................................................................................. (3)

_________________

4. Credit available from prior year(s) (From Schedule V) ................................................................................ (4)

_________________

5. Total credit available (Add lines 3 and 4) ..................................................................................................... (5)

_________________

6. Franchise and Excise Tax liability before any credits (From Schedule A, Line 3 plus Schedule B, Line 5 )(6)

_________________

7. Limitation on Credit (50% of line 6) .............................................................................................................. (7)

_________________

8. Franchise and Excise Tax liability before any credits (From Schedule A, Line 3 plus Schedule B, Line 5 )(8)

_________________

9. Credits from Schedule D, Lines 1, 2, 3, and 6 ............................................................................................. (9)

_________________

10. Tax before Industrial Machinery Credit (Line 8 less Line 9) ...................................................................... (10)

_________________

11. Amount available in Current Year (Least of Lines 5, 7, or 10; transfer to Schedule D, Line 4) ................ (11)

_________________

PART 2

RECAPTURE OF EXCISE TAX CREDIT

In the event that any industrial machinery is sold or removed and credit has been taken against franchise and/or excise taxes, the following

formula is to be used to recapture the tax credit taken for each item of machinery:

Credit taken on purchase of machinery X percentage of useful life remaining at time of sale or removal = Amount of credit to be recaptured.

Total amount of recapture to be used to increase franchise and excise tax liability (Transfer to Schedule B,

$

Line 6) .......................................................................................................................................................................

_________________

INTERNET (11-06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1