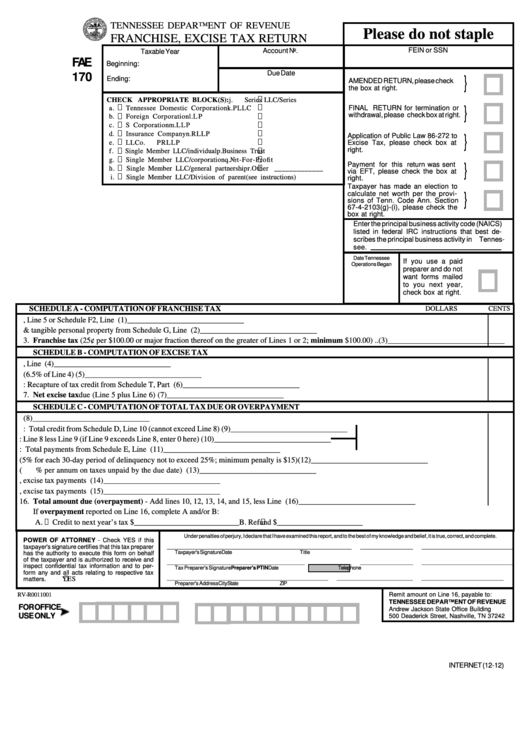

Form Fae 170 - Franchise, Excise Tax Return

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

Please do not staple

FRANCHISE, EXCISE TAX RETURN

Account No.

FEIN or SSN

Taxable Year

FAE

Beginning:

Due Date

170

}

Ending:

AMENDED RETURN, please check

the box at right.

CHECK APPROPRIATE BLOCK(S):

j.

Series LLC/Series

FINAL RETURN for termination or

a.

Tennessee Domestic Corporation

k.

PLLC

}

withdrawal, please check box at right.

b.

Foreign Corporation

l.

L P

c.

S Corporation

m.

LLP

d.

Insurance Company

n.

RLLP

Application of Public Law 86-272 to

}

e.

LLC

o.

PRLLP

Excise Tax, please check box at

right.

f.

Single Member LLC/individual

p.

Business Trust

g.

Single Member LLC/corporation

q.

Not-For-Profit

Payment for this return was sent

}

h.

Single Member LLC/general partnership r.

Other

_____________

via EFT, please check the box at

i.

Single Member LLC/Division of parent(see instructions)

right.

Taxpayer has made an election to

calculate net worth per the provi-

}

sions of Tenn. Code Ann. Section

67-4-2103(g)-(i), please check the

box at right.

Enter the principal business activity code (NAICS)

listed in federal IRC instructions that best de-

scribes the principal business activity in Tennes-

see.

Date Tennessee

If you use a paid

Operations Began

preparer and do not

want forms mailed

to you next year,

check box at right.

SCHEDULE A - COMPUTATION OF FRANCHISE TAX

DOLLARS

CENTS

1. Total net worth from Schedule F1, Line 5 or Schedule F2, Line 3 ......................................................................... (1) ______________________________

2. Total real & tangible personal property from Schedule G, Line 15 ....................................................................... (2) ______________________________

3. Franchise tax (25¢ per $100.00 or major fraction thereof on the greater of Lines 1 or 2; minimum $100.00) .. (3) ______________________________

SCHEDULE B - COMPUTATION OF EXCISE TAX

4. Income subject to excise tax from Schedule J, Line 33 ........................................................................................... (4) ______________________________

5. Excise tax (6.5% of Line 4) ..................................................................................................................................... (5) ______________________________

6. Add: Recapture of tax credit from Schedule T, Part 2 ............................................................................................ (6) ______________________________

7. Net excise tax due (Line 5 plus Line 6) ................................................................................................................ (7) ______________________________

SCHEDULE C - COMPUTATION OF TOTAL TAX DUE OR OVERPAYMENT

8. Total Franchise and Excise taxes - Add lines 3 and 7 ..........................................................

(8) ______________________________

9. Deduct: Total credit from Schedule D, Line 10 (cannot exceed Line 8) .............................

(9) ______________________________

10. Subtotal: Line 8 less Line 9 (if Line 9 exceeds Line 8, enter 0 here) ....................................

(10) ______________________________

11. Deduct: Total payments from Schedule E, Line 7 ..............................................................

(11) ______________________________

12. Penalty (5% for each 30-day period of delinquency not to exceed 25%; minimum penalty is $15)

(12) ______________________________

13. Interest (

% per annum on taxes unpaid by the due date) .............................................................................. (13) ______________________________

14. Penalty on estimated franchise, excise tax payments ........................................................................................... (14) ______________________________

15. Interest on estimated franchise, excise tax payments ........................................................................................... (15) ______________________________

16. Total amount due (overpayment) - Add lines 10, 12, 13, 14, and 15, less Line 11 ......................................... (16) ______________________________

If overpayment reported on Line 16, complete A and/or B:

A.

Credit to next year’s tax $ ___________________________

B.

Refund $ ______________________

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and complete.

POWER OF ATTORNEY - Check YES if this

taxpayer's signature certifies that this tax preparer

_______________________________________________________________

__________________

_______________________________

Taxpayer's Signature

Date

Title

has the authority to execute this form on behalf

of the taxpayer and is authorized to receive and

_______________________________________________

_____________

__________________

_______________________________

inspect confidential tax information and to per-

Tax Preparer's Signature

Preparer's PTIN

Date

Telephone

form any and all acts relating to respective tax

_______________________________________________________

__________________________

________

____________________

matters.

YES

Preparer's Address

City

State

ZIP

Remit amount on Line 16, payable to:

RV-R0011001

TENNESSEE DEPARTMENT OF REVENUE

FOR OFFICE

Andrew Jackson State Office Building

USE ONLY

500 Deaderick Street, Nashville, TN 37242

INTERNET (12-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8