600215

2

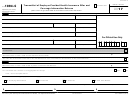

Form 1095-C (2015)

Page

Instructions for Recipient

Part II. Employer Offer and Coverage, Lines 14–16

Line 14. The codes listed below for line 14 describe the coverage that your employer offered to

You are receiving this Form 1095-C because your employer is an Applicable Large Employer

you and your spouse and dependent(s), if any. (If you received an offer of coverage through a

subject to the employer shared responsibility provision in the Affordable Care Act. This Form

multiemployer plan due to your membership in a union, that offer may not be shown on line 14.)

1095-C includes information about the health insurance coverage offered to you by your

The information on line 14 relates to eligibility for coverage subsidized by the premium tax credit

employer. Form 1095-C, Part II, includes information about the coverage, if any, your employer

for you, your spouse, and dependent(s). For more information about the premium tax credit, see

offered to you and your spouse and dependent(s). If you purchased health insurance coverage

Pub. 974.

through the Health Insurance Marketplace and wish to claim the premium tax credit, this

1A. Minimum essential coverage providing minimum value offered to you with an employee

information will assist you in determining whether you are eligible. For more information about

contribution for self-only coverage equal to or less than 9.5% of the 48 contiguous states single

the premium tax credit, see Pub. 974, Premium Tax Credit (PTC). You may receive multiple

federal poverty line and minimum essential coverage offered to your spouse and dependent(s)

Forms 1095-C if you had multiple employers during the year that were Applicable Large

(referred to here as a Qualifying Offer). This code may be used to report for specific months for

Employers (for example, you left employment with one Applicable Large Employer and began a

which a Qualifying Offer was made, even if you did not receive a Qualifying Offer for all 12

new position of employment with another Applicable Large Employer). In that situation, each

months of the calendar year.

Form 1095-C would have information only about the health insurance coverage offered to you

1B. Minimum essential coverage providing minimum value offered to you and minimum essential

by the employer identified on the form. If your employer is not an Applicable Large Employer it is

not required to furnish you a Form 1095-C providing information about the health coverage it

coverage NOT offered to your spouse or dependent(s).

offered.

1C. Minimum essential coverage providing minimum value offered to you and minimum essential

coverage offered to your dependent(s) but NOT your spouse.

In addition, if you, or any other individual who is offered health coverage because of their

relationship to you (referred to here as family members), enrolled in your employer's health plan

1D. Minimum essential coverage providing minimum value offered to you and minimum essential

and that plan is a type of plan referred to as a "self-insured" plan, Form 1095-C, Part III provides

coverage offered to your spouse but NOT your dependent(s).

information to assist you in completing your income tax return by showing you or those family

1E. Minimum essential coverage providing minimum value offered to you and minimum essential

members had qualifying health coverage (referred to as "minimum essential coverage") for some

coverage offered to your dependent(s) and spouse.

or all months during the year.

1F. Minimum essential coverage NOT providing minimum value offered to you, or you and your

If your employer provided you or a family member health coverage through an insured health

spouse or dependent(s), or you, your spouse, and dependent(s).

plan or in another manner, the issuer of the insurance or the sponsor of the plan providing the

1G. You were NOT a full-time employee for any month of the calendar year but were enrolled in

coverage will furnish you information about the coverage separately on Form 1095-B, Health

self-insured employer-sponsored coverage for one or more months of the calendar year. This

Coverage. Similarly, if you or a family member obtained minimum essential coverage from

code will be entered in the All 12 Months box on line 14.

another source, such as a government-sponsored program, an individual market plan, or

1H. No offer of coverage (you were NOT offered any health coverage or you were offered

miscellaneous coverage designated by the Department of Health and Human Services, the

coverage that is NOT minimum essential coverage).

provider of that coverage will furnish you information about that coverage on Form 1095-B. If

1I. Your employer claimed "Qualifying Offer Transition Relief" for 2015 and for at least one

you or a family member enrolled in a qualified health plan through a Health Insurance

month of the year you (and your spouse or dependent(s)) did not receive a Qualifying Offer. Note

Marketplace, the Health Insurance Marketplace will report information about that coverage on

that your employer has also provided a contact number at which you may request further

Form 1095-A, Health Insurance Marketplace Statement.

information about the health coverage, if any, you were offered (see line 10).

Employers are required to furnish Form 1095-C only to the employee. As the

Line 15. This line reports the employee share of the lowest-cost monthly premium for self-only

recipient of this Form 1095-C, you should provide a copy to any family members

TIP

minimum essential coverage providing minimum value that your employer offered you. The

covered under a self-insured employer-sponsored plan listed in Part III if they

amount reported on line 15 may not be the amount you paid for coverage if, for example, you

request it for their records.

chose to enroll in more expensive coverage such as family coverage. Line 15 will show an

amount only if code 1B, 1C, 1D, or 1E is entered on line 14. If you were offered coverage but not

Part I. Employee

required to contribute any amount towards the premium, this line will report a “0.00” for the

Lines 1–6. Part I, lines 1–6, reports information about you, the employee.

amount.

Line 2. This is your social security number (SSN). For your protection, this form may show only

Line 16. This code provides the IRS information to administer the employer shared responsibility

the last four digits of your SSN. However, the issuer is required to report your complete SSN to

provisions. Other than a code 2C which reflects your enrollment in your employer's coverage,

the IRS.

none of this information affects your eligibility for the premium tax credit. For more information

about the employer shared responsibility provisions, see IRS.gov.

▲

If you do not provide your SSN and the SSNs of all covered individuals to the plan

!

administrator, the IRS may not be able to match the Form 1095-C to determine that

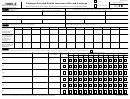

Part III. Covered Individuals, Lines 17–22

you and the other covered individuals have complied with the individual shared

Part III reports the name, SSN (or TIN for covered individuals other than the employee listed in

CAUTION

responsibility provision. For covered individuals other than the employee listed in

Part I), and coverage information about each individual (including any full-time employee and

Part I, a Taxpayer Identification Number (TIN) may be provided instead of an SSN.

non-full-time employee, and any employee's family members) covered under the employer's

health plan, if the plan is "self-insured." A date of birth will be entered in column (c) only if an

Part I. Applicable Large Employer Member (Employer)

SSN (or TIN for covered individuals other than the employee listed in Part I) is not entered in

Lines 7–13. Part I, lines 7–13, reports information about your employer.

column (b). Column (d) will be checked if the individual was covered for at least one day in every

Line 10. This line includes a telephone number for the person whom you may call if you have

month of the year. For individuals who were covered for some but not all months, information

questions about the information reported on the form or to report errors in the information on the

will be entered in column (e) indicating the months for which these individuals were covered. If

form and ask that they be corrected.

there are more than 6 covered individuals, see the additional covered individuals on Part III,

Continuation Sheet(s).

1

1 2

2 3

3