Form S-220 - Buyer'S Claim For Refund Of Wisconsin State, County And Stadium Sales Taxes

ADVERTISEMENT

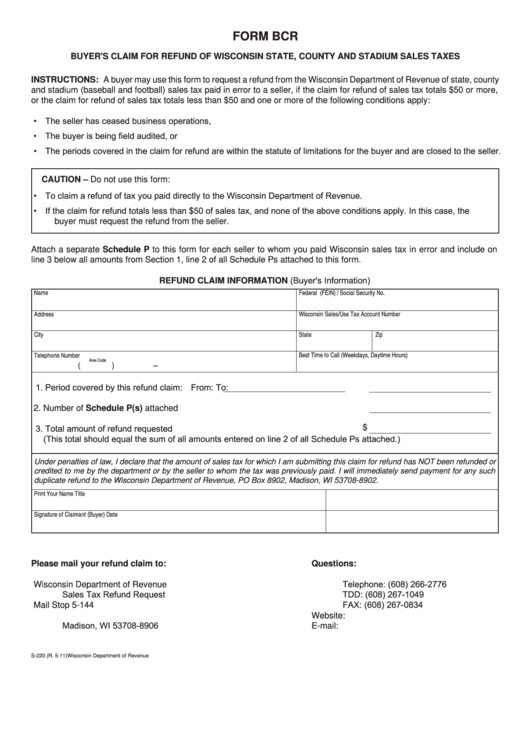

FORM BCR

BUYER'S CLAIM FOR REFUND OF WISCONSIN STATE, COUNTY AND STADIUM SALES TAXES

INSTRUCTIONS: A buyer may use this form to request a refund from the Wisconsin Department of Revenue of state, county

and stadium (baseball and football) sales tax paid in error to a seller, if the claim for refund of sales tax totals $50 or more,

or the claim for refund of sales tax totals less than $50 and one or more of the following conditions apply:

• The seller has ceased business operations,

• The buyer is being field audited, or

• The periods covered in the claim for refund are within the statute of limitations for the buyer and are closed to the seller.

CAUTION – Do not use this form:

• To claim a refund of tax you paid directly to the Wisconsin Department of Revenue.

• If the claim for refund totals less than $50 of sales tax, and none of the above conditions apply. In this case, the

buyer must request the refund from the seller.

Attach a separate Schedule P to this form for each seller to whom you paid Wisconsin sales tax in error and include on

line 3 below all amounts from Section 1, line 2 of all Schedule Ps attached to this form.

REFUND CLAIM INFORMATION (Buyer's Information)

Name

Federal I.D. Number (FEIN) / Social Security No.

Wisconsin Sales/Use Tax Account Number

Address

City

State

Zip

Telephone Number

Best Time to Call (Weekdays, Daytime Hours)

Area Code

(

)

–

1. Period covered by this refund claim: From:

To:

2.

Number of Schedule P(s) attached . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Total amount of refund requested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

(This total should equal the sum of all amounts entered on line 2 of all Schedule Ps attached.)

Under penalties of law, I declare that the amount of sales tax for which I am submitting this claim for refund has NOT been refunded or

credited to me by the department or by the seller to whom the tax was previously paid. I will immediately send payment for any such

duplicate refund to the Wisconsin Department of Revenue, PO Box 8902, Madison, WI 53708-8902.

Print Your Name

Title

Signature of Claimant (Buyer)

Date

Please mail your refund claim to:

Questions:

Telephone: (608) 266-2776

Wisconsin Department of Revenue

Sales Tax Refund Request

TDD: (608) 267-1049

FAX: (608) 267-0834

Mail Stop 5-144

P.O. Box 8906

Website:

Madison, WI 53708-8906

E-mail: sales10@revenue.wi.gov

S-220 (R. 5-11)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1