Form Rv-F1319901 - Sales And Use Tax Exempt Sales Election

ADVERTISEMENT

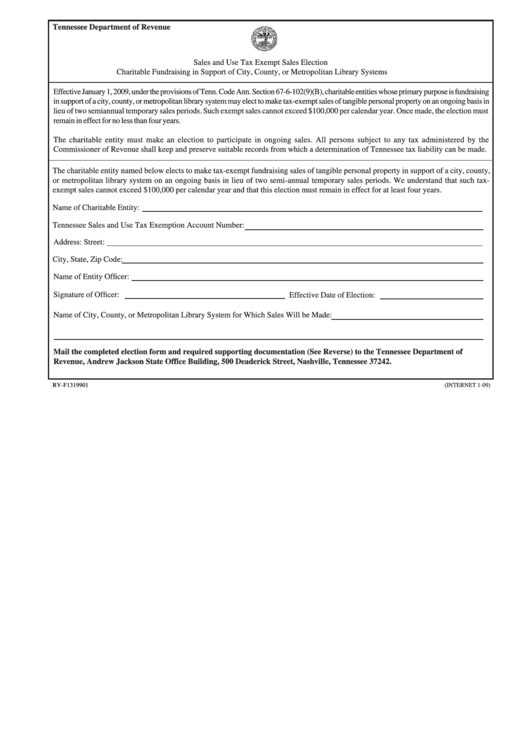

Tennessee Department of Revenue

Sales and Use Tax Exempt Sales Election

Charitable Fundraising in Support of City, County, or Metropolitan Library Systems

Effective January 1, 2009, under the provisions of Tenn. Code Ann. Section 67-6-102(9)(B), charitable entities whose primary purpose is fundraising

in support of a city, county, or metropolitan library system may elect to make tax-exempt sales of tangible personal property on an ongoing basis in

lieu of two semiannual temporary sales periods. Such exempt sales cannot exceed $100,000 per calendar year. Once made, the election must

remain in effect for no less than four years.

The charitable entity must make an election to participate in ongoing sales. All persons subject to any tax administered by the

Commissioner of Revenue shall keep and preserve suitable records from which a determination of Tennessee tax liability can be made.

The charitable entity named below elects to make tax-exempt fundraising sales of tangible personal property in support of a city, county,

or metropolitan library system on an ongoing basis in lieu of two semi-annual temporary sales periods. We understand that such tax-

exempt sales cannot exceed $100,000 per calendar year and that this election must remain in effect for at least four years.

Name of Charitable Entity:

Tennessee Sales and Use Tax Exemption Account Number:

Address: Street:

City, State, Zip Code:

Name of Entity Officer:

Signature of Officer:

Effective Date of Election:

Name of City, County, or Metropolitan Library System for Which Sales Will be Made:

Mail the completed election form and required supporting documentation (See Reverse) to the Tennessee Department of

Revenue, Andrew Jackson State Office Building, 500 Deaderick Street, Nashville, Tennessee 37242.

RV-F1319901

(INTERNET 1-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2