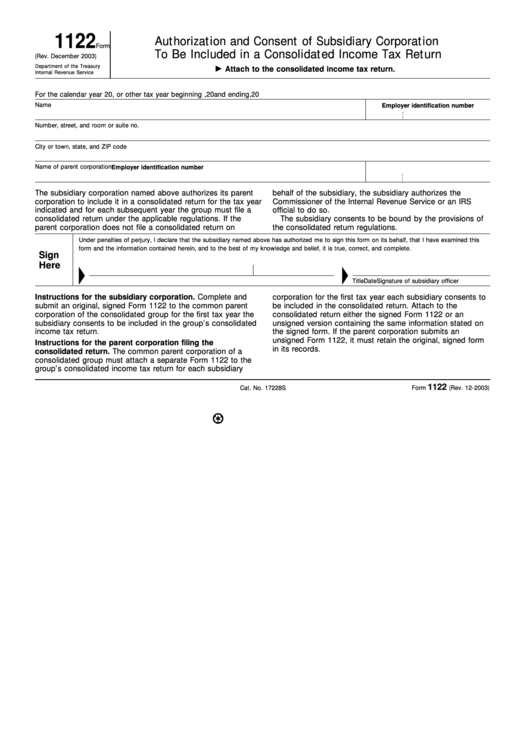

1122

Authorization and Consent of Subsidiary Corporation

Form

To Be Included in a Consolidated Income Tax Return

(Rev. December 2003)

Department of the Treasury

Attach to the consolidated income tax return.

Internal Revenue Service

For the calendar year 20

, or other tax year beginning

, 20

and ending

, 20

Name

Employer identification number

Number, street, and room or suite no.

City or town, state, and ZIP code

Name of parent corporation

Employer identification number

The subsidiary corporation named above authorizes its parent

behalf of the subsidiary, the subsidiary authorizes the

corporation to include it in a consolidated return for the tax year

Commissioner of the Internal Revenue Service or an IRS

indicated and for each subsequent year the group must file a

official to do so.

consolidated return under the applicable regulations. If the

The subsidiary consents to be bound by the provisions of

parent corporation does not file a consolidated return on

the consolidated return regulations.

Under penalties of perjury, I declare that the subsidiary named above has authorized me to sign this form on its behalf, that I have examined this

form and the information contained herein, and to the best of my knowledge and belief, it is true, correct, and complete.

Sign

Here

Signature of subsidiary officer

Date

Title

Instructions for the subsidiary corporation. Complete and

corporation for the first tax year each subsidiary consents to

submit an original, signed Form 1122 to the common parent

be included in the consolidated return. Attach to the

corporation of the consolidated group for the first tax year the

consolidated return either the signed Form 1122 or an

subsidiary consents to be included in the group’s consolidated

unsigned version containing the same information stated on

income tax return.

the signed form. If the parent corporation submits an

unsigned Form 1122, it must retain the original, signed form

Instructions for the parent corporation filing the

in its records.

consolidated return. The common parent corporation of a

consolidated group must attach a separate Form 1122 to the

group’s consolidated income tax return for each subsidiary

1122

Cat. No. 17228S

Form

(Rev. 12-2003)

1

1