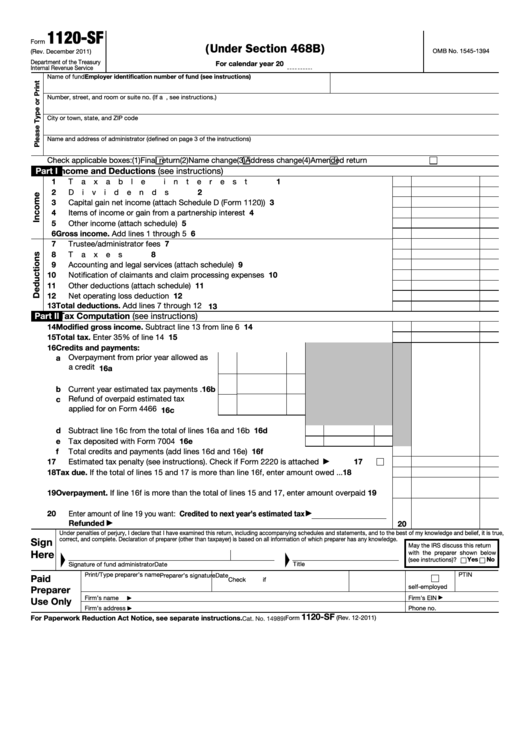

1120-SF

U.S. Income Tax Return for Settlement Funds

Form

(Under Section 468B)

OMB No. 1545-1394

(Rev. December 2011)

Department of the Treasury

For calendar year 20

Internal Revenue Service

Name of fund

Employer identification number of fund (see instructions)

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City or town, state, and ZIP code

Name and address of administrator (defined on page 3 of the instructions)

Check applicable boxes:

(1)

Final return

(2)

Name change

(3)

Address change

(4)

Amended return

Part I

Income and Deductions (see instructions)

1

1

Taxable interest

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

2

Dividends

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Capital gain net income (attach Schedule D (Form 1120)) .

.

.

.

.

.

.

.

.

.

.

3

4

Items of income or gain from a partnership interest .

.

.

.

.

.

.

.

.

.

.

.

.

4

5

5

Other income (attach schedule)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Gross income. Add lines 1 through 5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Trustee/administrator fees .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

8

Taxes .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Accounting and legal services (attach schedule) .

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

Notification of claimants and claim processing expenses .

.

.

.

.

.

.

.

.

.

.

10

11

11

Other deductions (attach schedule) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

12

Net operating loss deduction .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

Total deductions. Add lines 7 through 12 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

Part II

Tax Computation (see instructions)

14

Modified gross income. Subtract line 13 from line 6 .

14

.

.

.

.

.

.

.

.

.

.

.

15

Total tax. Enter 35% of line 14

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

16

Credits and payments:

a Overpayment from prior year allowed as

a credit

.

.

.

.

.

.

.

.

.

.

.

16a

b Current year estimated tax payments

16b

.

c Refund

of

overpaid

estimated

tax

applied for on Form 4466

.

.

.

.

.

16c

d Subtract line 16c from the total of lines 16a and 16b

16d

.

.

.

.

e Tax deposited with Form 7004

.

.

.

.

.

.

.

.

.

.

.

16e

f

Total credits and payments (add lines 16d and 16e) .

.

.

.

.

.

.

.

.

.

.

.

.

16f

17

17

Estimated tax penalty (see instructions). Check if Form 2220 is attached .

.

.

.

.

▶

18

Tax due. If the total of lines 15 and 17 is more than line 16f, enter amount owed .

.

.

18

19

Overpayment. If line 16f is more than the total of lines 15 and 17, enter amount overpaid

19

20

Enter amount of line 19 you want: Credited to next year’s estimated tax

▶

Refunded

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

20

▶

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

Sign

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

May the IRS discuss this return

Here

with the preparer shown below

Yes

No

(see instructions)?

Title

Signature of fund administrator

Date

Print/Type preparer’s name

PTIN

Preparer’s signature

Date

Paid

Check

if

self-employed

Preparer

Firm’s name

Firm's EIN

▶

Use Only

▶

Firm’s address

Phone no.

▶

1120-SF

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 12-2011)

Cat. No. 14989I

1

1 2

2