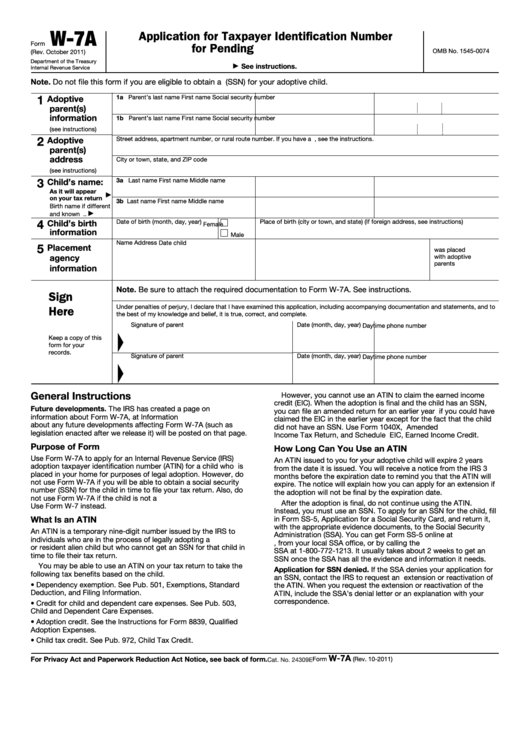

W-7A

Application for Taxpayer Identification Number

Form

for Pending U.S. Adoptions

OMB No. 1545-0074

(Rev. October 2011)

Department of the Treasury

See instructions.

▶

Internal Revenue Service

Note. Do not file this form if you are eligible to obtain a U.S. social security number (SSN) for your adoptive child.

1

Adoptive

1a Parent’s last name

First name

Social security number

parent(s)

information

1b Parent’s last name

First name

Social security number

(see instructions)

2

Adoptive

Street address, apartment number, or rural route number. If you have a P.O. box, see the instructions.

parent(s)

address

City or town, state, and ZIP code

(see instructions)

3

Child’s name:

3a Last name

First name

Middle name

As it will appear

▶

on your tax return

3b Last name

First name

Middle name

Birth name if different

and known .

.

▶

4

Child’s birth

Date of birth (month, day, year)

Place of birth (city or town, and state) (If foreign address, see instructions)

Female

information

Male

Name

Address

Date child

5

Placement

was placed

agency

with adoptive

parents

information

Note. Be sure to attach the required documentation to Form W-7A. See instructions.

Sign

Under penalties of perjury, I declare that I have examined this application, including accompanying documentation and statements, and to

Here

the best of my knowledge and belief, it is true, correct, and complete.

Signature of parent

Date (month, day, year)

Daytime phone number

Keep a copy of this

form for your

records.

Signature of parent

Date (month, day, year)

Daytime phone number

General Instructions

However, you cannot use an ATIN to claim the earned income

credit (EIC). When the adoption is final and the child has an SSN,

Future developments. The IRS has created a page on IRS.gov for

you can file an amended return for an earlier year if you could have

information about Form W-7A, at Information

claimed the EIC in the earlier year except for the fact that the child

about any future developments affecting Form W-7A (such as

did not have an SSN. Use Form 1040X, Amended U.S. Individual

legislation enacted after we release it) will be posted on that page.

Income Tax Return, and Schedule EIC, Earned Income Credit.

Purpose of Form

How Long Can You Use an ATIN

Use Form W-7A to apply for an Internal Revenue Service (IRS)

An ATIN issued to you for your adoptive child will expire 2 years

adoption taxpayer identification number (ATIN) for a child who is

from the date it is issued. You will receive a notice from the IRS 3

placed in your home for purposes of legal adoption. However, do

months before the expiration date to remind you that the ATIN will

not use Form W-7A if you will be able to obtain a social security

expire. The notice will explain how you can apply for an extension if

number (SSN) for the child in time to file your tax return. Also, do

the adoption will not be final by the expiration date.

not use Form W-7A if the child is not a U.S. citizen or resident alien.

After the adoption is final, do not continue using the ATIN.

Use Form W-7 instead.

Instead, you must use an SSN. To apply for an SSN for the child, fill

What Is an ATIN

in Form SS-5, Application for a Social Security Card, and return it,

with the appropriate evidence documents, to the Social Security

An ATIN is a temporary nine-digit number issued by the IRS to

Administration (SSA). You can get Form SS-5 online at

individuals who are in the process of legally adopting a U.S. citizen

, from your local SSA office, or by calling the

or resident alien child but who cannot get an SSN for that child in

SSA at 1-800-772-1213. It usually takes about 2 weeks to get an

time to file their tax return.

SSN once the SSA has all the evidence and information it needs.

You may be able to use an ATIN on your tax return to take the

Application for SSN denied. If the SSA denies your application for

following tax benefits based on the child.

an SSN, contact the IRS to request an extension or reactivation of

• Dependency exemption. See Pub. 501, Exemptions, Standard

the ATIN. When you request the extension or reactivation of the

Deduction, and Filing Information.

ATIN, include the SSA’s denial letter or an explanation with your

correspondence.

• Credit for child and dependent care expenses. See Pub. 503,

Child and Dependent Care Expenses.

• Adoption credit. See the Instructions for Form 8839, Qualified

Adoption Expenses.

• Child tax credit. See Pub. 972, Child Tax Credit.

W-7A

For Privacy Act and Paperwork Reduction Act Notice, see back of form.

Form

(Rev. 10-2011)

Cat. No. 24309E

1

1 2

2