Instructions For Schedule D-1 - Sales Of Business Property - 2013

ADVERTISEMENT

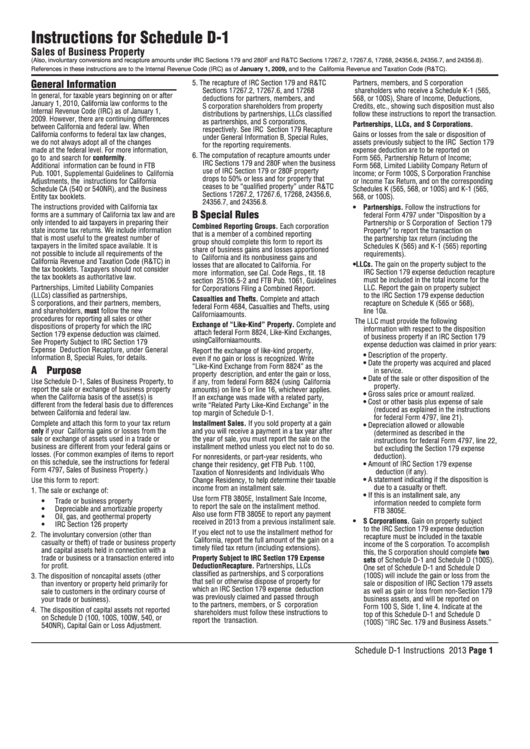

Instructions for Schedule D-1

Sales of Business Property

(Also, involuntary conversions and recapture amounts under IRC Sections 179 and 280F and R&TC Sections 17267.2, 17267.6, 17268, 24356.6, 24356.7, and 24356.8).

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

5. The recapture of IRC Section 179 and R&TC

Partners, members, and S corporation

Sections 17267.2, 17267.6, and 17268

shareholders who receive a Schedule K-1 (565,

In general, for taxable years beginning on or after

deductions for partners, members, and

568, or 100S), Share of Income, Deductions,

January 1, 2010, California law conforms to the

S corporation shareholders from property

Credits, etc., showing such disposition must also

Internal Revenue Code (IRC) as of January 1,

distributions by partnerships, LLCs classified

follow these instructions to report the transaction.

2009. However, there are continuing differences

as partnerships, and S corporations,

Partnerships, LLCs, and S Corporations.

between California and federal law. When

respectively. See IRC Section 179 Recapture

California conforms to federal tax law changes,

Gains or losses from the sale or disposition of

under General Information B, Special Rules,

we do not always adopt all of the changes

assets previously subject to the IRC Section 179

for the reporting requirements.

made at the federal level. For more information,

expense deduction are to be reported on

6. The computation of recapture amounts under

go to ftb.ca.gov and search for conformity.

Form 565, Partnership Return of Income;

IRC Sections 179 and 280F when the business

Additional information can be found in FTB

Form 568, Limited Liability Company Return of

use of IRC Section 179 or 280F property

Pub. 1001, Supplemental Guidelines to California

Income; or Form 100S, S Corporation Franchise

drops to 50% or less and for property that

Adjustments, the instructions for California

or Income Tax Return, and on the corresponding

ceases to be “qualified property” under R&TC

Schedule CA (540 or 540NR), and the Business

Schedules K (565, 568, or 100S) and K-1 (565,

Sections 17267.2, 17267.6, 17268, 24356.6,

Entity tax booklets.

568, or 100S).

24356.7, and 24356.8.

The instructions provided with California tax

• Partnerships. Follow the instructions for

B Special Rules

forms are a summary of California tax law and are

federal Form 4797 under “Disposition by a

only intended to aid taxpayers in preparing their

Partnership or S Corporation of Section 179

Combined Reporting Groups. Each corporation

state income tax returns. We include information

Property” to report the transaction on

that is a member of a combined reporting

that is most useful to the greatest number of

the partnership tax return (including the

group should complete this form to report its

taxpayers in the limited space available. It is

Schedules K (565) and K-1 (565) reporting

share of business gains and losses apportioned

not possible to include all requirements of the

requirements).

to California and its nonbusiness gains and

California Revenue and Taxation Code (R&TC) in

• LLCs. The gain on the property subject to the

losses that are allocated to California. For

the tax booklets. Taxpayers should not consider

IRC Section 179 expense deduction recapture

more information, see Cal. Code Regs., tit. 18

the tax booklets as authoritative law.

must be included in the total income for the

section 25106.5-2 and FTB Pub. 1061, Guidelines

Partnerships, Limited Liability Companies

LLC. Report the gain on property subject

for Corporations Filing a Combined Report.

(LLCs) classified as partnerships,

to the IRC Section 179 expense deduction

Casualties and Thefts. Complete and attach

S corporations, and their partners, members,

recapture on Schedule K (565 or 568),

federal Form 4684, Casualties and Thefts, using

and shareholders, must follow the new

line 10a.

California amounts.

procedures for reporting all sales or other

The LLC must provide the following

Exchange of “Like-Kind” Property. Complete and

dispositions of property for which the IRC

information with respect to the disposition

attach federal Form 8824, Like-Kind Exchanges,

Section 179 expense deduction was claimed.

of business property if an IRC Section 179

using California amounts.

See Property Subject to IRC Section 179

expense deduction was claimed in prior years:

Expense Deduction Recapture, under General

Report the exchange of like-kind property,

• Description of the property.

Information B, Special Rules, for details.

even if no gain or loss is recognized. Write

• Date the property was acquired and placed

“Like-Kind Exchange from Form 8824” as the

A Purpose

in service.

property description, and enter the gain or loss,

• Date of the sale or other disposition of the

Use Schedule D-1, Sales of Business Property, to

if any, from federal Form 8824 (using California

property.

report the sale or exchange of business property

amounts) on line 5 or line 16, whichever applies.

• Gross sales price or amount realized.

when the California basis of the asset(s) is

If an exchange was made with a related party,

• Cost or other basis plus expense of sale

different from the federal basis due to differences

write “Related Party Like-Kind Exchange” in the

(reduced as explained in the instructions

between California and federal law.

top margin of Schedule D-1.

for federal Form 4797, line 21).

Complete and attach this form to your tax return

Installment Sales. If you sold property at a gain

• Depreciation allowed or allowable

only if your California gains or losses from the

and you will receive a payment in a tax year after

(determined as described in the

sale or exchange of assets used in a trade or

the year of sale, you must report the sale on the

instructions for federal Form 4797, line 22,

business are different from your federal gains or

installment method unless you elect not to do so.

but excluding the Section 179 expense

losses. (For common examples of items to report

deduction).

For nonresidents, or part-year residents, who

on this schedule, see the instructions for federal

• Amount of IRC Section 179 expense

change their residency, get FTB Pub. 1100,

Form 4797, Sales of Business Property.)

deduction (if any).

Taxation of Nonresidents and Individuals Who

• A statement indicating if the disposition is

Use this form to report:

Change Residency, to help determine their taxable

due to a casualty or theft.

income from an installment sale.

1. The sale or exchange of:

• If this is an installment sale, any

Use form FTB 3805E, Installment Sale Income,

• Trade or business property

information needed to complete form

to report the sale on the installment method.

• Depreciable and amortizable property

FTB 3805E.

Also use form FTB 3805E to report any payment

• Oil, gas, and geothermal property

• S Corporations. Gain on property subject

received in 2013 from a previous installment sale.

• IRC Section 126 property

to the IRC Section 179 expense deduction

If you elect not to use the installment method for

2. The involuntary conversion (other than

recapture must be included in the taxable

California, report the full amount of the gain on a

casualty or theft) of trade or business property

income of the S corporation. To accomplish

timely filed tax return (including extensions).

and capital assets held in connection with a

this, the S corporation should complete two

trade or business or a transaction entered into

Property Subject to IRC Section 179 Expense

sets of Schedule D-1 and Schedule D (100S).

for profit.

Deduction Recapture. Partnerships, LLCs

One set of Schedule D-1 and Schedule D

classified as partnerships, and S corporations

(100S) will include the gain or loss from the

3. The disposition of noncapital assets (other

that sell or otherwise dispose of property for

sale or disposition of IRC Section 179 assets

than inventory or property held primarily for

which an IRC Section 179 expense deduction

as well as gain or loss from non-Section 179

sale to customers in the ordinary course of

was previously claimed and passed through

business assets, and will be reported on

your trade or business).

to the partners, members, or S corporation

Form 100 S, Side 1, line 4. Indicate at the

4. The disposition of capital assets not reported

shareholders must follow these instructions to

top of this Schedule D-1 and Schedule D

on Schedule D (100, 100S, 100W, 540, or

report the transaction.

(100S) “IRC Sec. 179 and Business Assets.”

540NR), Capital Gain or Loss Adjustment.

Schedule D-1 Instructions 2013 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3