Instructions For Pa-20s/pa 65 Schedule D - Sale, Exchange Or Disposition Of Property - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

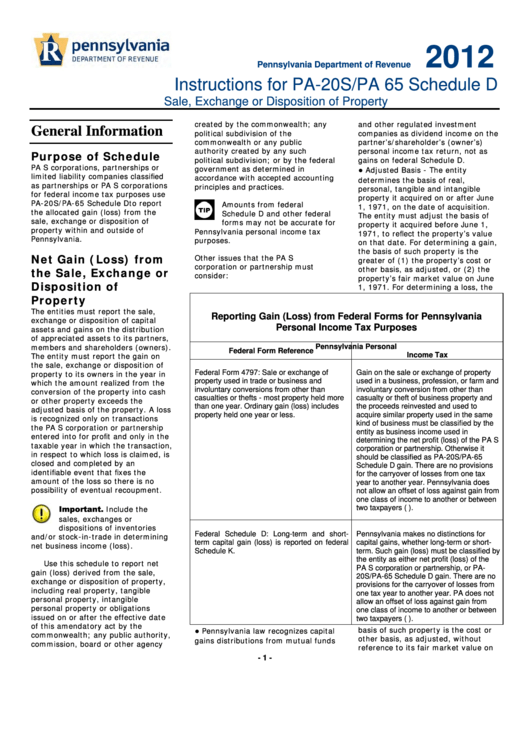

Instructions for PA-20S/PA 65 Schedule D

Sale, Exchange or Disposition of Property

created by the commonwealth; any

and other regulated investment

General Information

political subdivision of the

companies as dividend income on the

commonwealth or any public

partner’s/shareholder’s (owner’s)

authority created by any such

personal income tax return, not as

Purpose of Schedule

political subdivision; or by the federal

gains on federal Schedule D.

PA S corporations, partnerships or

government as determined in

●

Adjusted Basis - The entity

limited liability companies classified

accordance with accepted accounting

determines the basis of real,

as partnerships or PA S corporations

principles and practices.

personal, tangible and intangible

for federal income tax purposes use

property it acquired on or after June

PA-20S/PA-65 Schedule D to report

Amounts from federal

1, 1971, on the date of acquisition.

the allocated gain (loss) from the

Schedule D and other federal

The entity must adjust the basis of

sale, exchange or disposition of

forms may not be accurate for

property it acquired before June 1,

property within and outside of

Pennsylvania personal income tax

1971, to reflect the property’s value

Pennsylvania.

purposes.

on that date. For determining a gain,

the basis of such property is the

Net Gain (Loss) from

Other issues that the PA S

greater of (1) the property’s cost or

corporation or partnership must

other basis, as adjusted, or (2) the

the Sale, Exchange or

consider:

property’s fair market value on June

Disposition of

1, 1971. For determining a loss, the

Property

The entities must report the sale,

Reporting Gain (Loss) from Federal Forms for Pennsylvania

exchange or disposition of capital

Personal Income Tax Purposes

assets and gains on the distribution

of appreciated assets to its partners,

members and shareholders (owners).

Pennsylvania Personal

Federal Form Reference

The entity must report the gain on

Income Tax

the sale, exchange or disposition of

property to its owners in the year in

Federal Form 4797: Sale or exchange of

Gain on the sale or exchange of property

property used in trade or business and

used in a business, profession, or farm and

which the amount realized from the

involuntary conversions from other than

involuntary conversion from other than

conversion of the property into cash

casualties or thefts - most property held more

casualty or theft of business property and

or other property exceeds the

than one year. Ordinary gain (loss) includes

the proceeds reinvested and used to

adjusted basis of the property. A loss

property held one year or less.

acquire similar property used in the same

is recognized only on transactions

kind of business must be classified by the

the PA S corporation or partnership

entity as business income used in

entered into for profit and only in the

determining the net profit (loss) of the PA S

taxable year in which the transaction,

corporation or partnership. Otherwise it

in respect to which loss is claimed, is

should be classified as PA-20S/PA-65

closed and completed by an

Schedule D gain. There are no provisions

identifiable event that fixes the

for the carryover of losses from one tax

amount of the loss so there is no

year to another year. Pennsylvania does

possibility of eventual recoupment.

not allow an offset of loss against gain from

one class of income to another or between

Important.

Include the

two taxpayers (i.e. spouses).

sales, exchanges or

dispositions of inventories

Federal Schedule D: Long-term and short-

Pennsylvania makes no distinctions for

and/or stock-in-trade in determining

term capital gain (loss) is reported on federal

capital gains, whether long-term or short-

net business income (loss).

Schedule K.

term. Such gain (loss) must be classified by

the entity as either net profit (loss) of the

Use this schedule to report net

PA S corporation or partnership, or PA-

gain (loss) derived from the sale,

20S/PA-65 Schedule D gain. There are no

exchange or disposition of property,

provisions for the carryover of losses from

including real property, tangible

one tax year to another year. PA does not

personal property, intangible

allow an offset of loss against gain from

personal property or obligations

one class of income to another or between

issued on or after the effective date

two taxpayers (i.e. spouses).

of this amendatory act by the

●

basis of such property is the cost or

Pennsylvania law recognizes capital

commonwealth; any public authority,

other basis, as adjusted, without

gains distributions from mutual funds

commission, board or other agency

reference to its fair market value on

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6