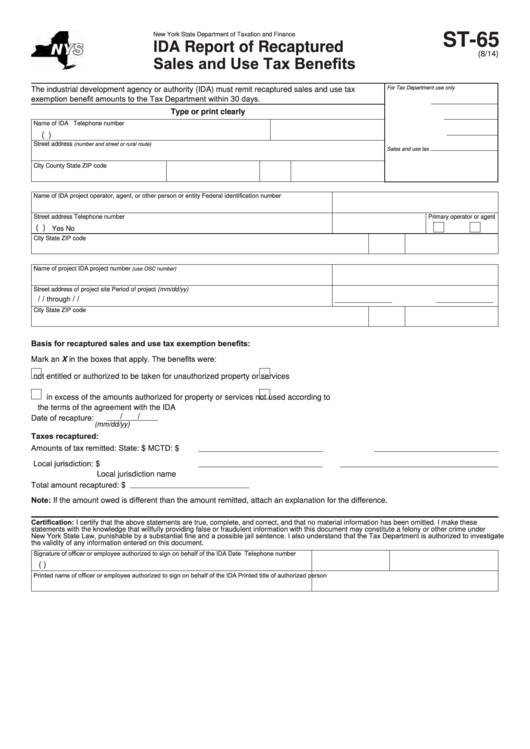

New York State Department of Taxation and Finance

ST-65

IDA Report of Recaptured

(8/14)

Sales and Use Tax Benefits

For Tax Department use only

The industrial development agency or authority (IDA) must remit recaptured sales and use tax

exemption benefit amounts to the Tax Department within 30 days.

Type or print clearly

Name of IDA

Telephone number

(

)

Street address

(number and street or rural route)

Sales and use tax

City

County

State

ZIP code

Name of IDA project operator, agent, or other person or entity

Federal identification number

Street address

Telephone number

Primary operator or agent

(

)

Yes

No

City

State

ZIP code

Name of project

IDA project number

(use OSC number)

Street address of project site

Period of project (mm/dd/yy)

/

/

/

/

through

City

State

ZIP code

Basis for recaptured sales and use tax exemption benefits:

Mark an X in the boxes that apply. The benefits were:

not entitled or authorized to be taken

for unauthorized property or services

in excess of the amounts authorized

for property or services not used according to

the terms of the agreement with the IDA

Date of recapture:

/

/

(mm/dd/yy)

Taxes recaptured:

Amounts of tax remitted:

State: $

MCTD: $

Local jurisdiction: $

Local jurisdiction name

Total amount recaptured: $

Note: If the amount owed is different than the amount remitted, attach an explanation for the difference.

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these

statements with the knowledge that willfully providing false or fraudulent information with this document may constitute a felony or other crime under

New York State Law, punishable by a substantial fine and a possible jail sentence. I also understand that the Tax Department is authorized to investigate

the validity of any information entered on this document.

Signature of officer or employee authorized to sign on behalf of the IDA

Date

Telephone number

(

)

Printed name of officer or employee authorized to sign on behalf of the IDA

Printed title of authorized person

1

1 2

2