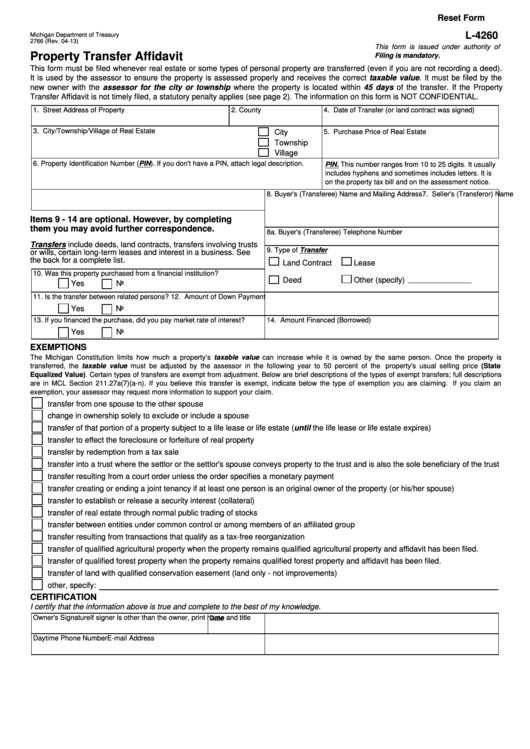

Reset Form

L-4260

Michigan Department of Treasury

2766 (Rev. 04-13)

This form is issued under authority of

Property Transfer Affidavit

P.A. 415 of 1994. Filing is mandatory.

This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed).

It is used by the assessor to ensure the property is assessed properly and receives the correct taxable value. It must be filed by the

new owner with the assessor for the city or township where the property is located within 45 days of the transfer. If the Property

Transfer Affidavit is not timely filed, a statutory penalty applies (see page 2). The information on this form is NOT CONFIDENTIAL.

1. Street Address of Property

2. County

4. Date of Transfer (or land contract was signed)

3. City/Township/Village of Real Estate

City

5. Purchase Price of Real Estate

Township

Village

6. Property Identification Number (PIN). If you don't have a PIN, attach legal description.

PIN. This number ranges from 10 to 25 digits. It usually

includes hyphens and sometimes includes letters. It is

on the property tax bill and on the assessment notice.

7. Seller's (Transferor) Name

8. Buyer's (Transferee) Name and Mailing Address

Items 9 - 14 are optional. However, by completing

them you may avoid further correspondence.

8a. Buyer's (Transferee) Telephone Number

Transfers include deeds, land contracts, transfers involving trusts

9. Type of Transfer

or wills, certain long-term leases and interest in a business. See

the back for a complete list.

Land Contract

Lease

10. Was this property purchased from a financial institution?

Deed

Other (specify)

Yes

No

11. Is the transfer between related persons?

12. Amount of Down Payment

Yes

No

13. If you financed the purchase, did you pay market rate of interest?

14. Amount Financed (Borrowed)

Yes

No

EXEMPTIONS

The Michigan Constitution limits how much a property’s taxable value can increase while it is owned by the same person. Once the property is

transferred, the taxable value must be adjusted by the assessor in the following year to 50 percent of the property's usual selling price (State

Equalized Value). Certain types of transfers are exempt from adjustment. Below are brief descriptions of the types of exempt transfers; full descriptions

are in MCL Section 211.27a(7)(a-n). If you believe this transfer is exempt, indicate below the type of exemption you are claiming. If you claim an

exemption, your assessor may request more information to support your claim.

transfer from one spouse to the other spouse

change in ownership solely to exclude or include a spouse

transfer of that portion of a property subject to a life lease or life estate (until the life lease or life estate expires)

transfer to effect the foreclosure or forfeiture of real property

transfer by redemption from a tax sale

transfer into a trust where the settlor or the settlor's spouse conveys property to the trust and is also the sole beneficiary of the trust

transfer resulting from a court order unless the order specifies a monetary payment

transfer creating or ending a joint tenancy if at least one person is an original owner of the property (or his/her spouse)

transfer to establish or release a security interest (collateral)

transfer of real estate through normal public trading of stocks

transfer between entities under common control or among members of an affiliated group

transfer resulting from transactions that qualify as a tax-free reorganization

transfer of qualified agricultural property when the property remains qualified agricultural property and affidavit has been filed.

transfer of qualified forest property when the property remains qualified forest property and affidavit has been filed.

transfer of land with qualified conservation easement (land only - not improvements)

other, specify:

CERTIFICATION

I certify that the information above is true and complete to the best of my knowledge.

Owner's Signature

If signer is other than the owner, print name and title

Date

Daytime Phone Number

E-mail Address

1

1 2

2