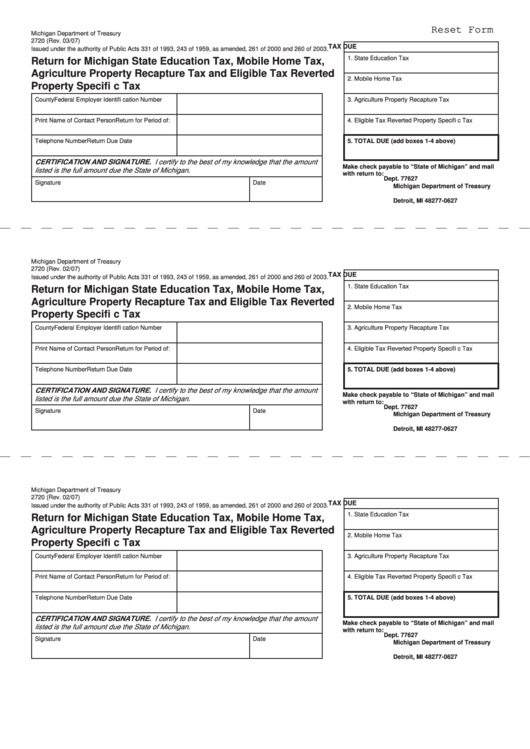

Reset Form

Michigan Department of Treasury

2720 (Rev. 03/07)

TAX DUE

Issued under the authority of Public Acts 331 of 1993, 243 of 1959, as amended, 261 of 2000 and 260 of 2003.

1. State Education Tax

Return for Michigan State Education Tax, Mobile Home Tax,

Agriculture Property Recapture Tax and Eligible Tax Reverted

2. Mobile Home Tax

Property Specifi c Tax

County

Federal Employer Identifi cation Number

3. Agriculture Property Recapture Tax

Print Name of Contact Person

Return for Period of:

4. Eligible Tax Reverted Property Specifi c Tax

Telephone Number

Return Due Date

5. TOTAL DUE (add boxes 1-4 above)

CERTIFICATION AND SIGNATURE. I certify to the best of my knowledge that the amount

Make check payable to “State of Michigan” and mail

listed is the full amount due the State of Michigan.

with return to:

Dept. 77627

Signature

Date

Michigan Department of Treasury

P.O. Box 77000

Detroit, MI 48277-0627

Michigan Department of Treasury

2720 (Rev. 02/07)

TAX DUE

Issued under the authority of Public Acts 331 of 1993, 243 of 1959, as amended, 261 of 2000 and 260 of 2003.

1. State Education Tax

Return for Michigan State Education Tax, Mobile Home Tax,

Agriculture Property Recapture Tax and Eligible Tax Reverted

2. Mobile Home Tax

Property Specifi c Tax

County

Federal Employer Identifi cation Number

3. Agriculture Property Recapture Tax

Print Name of Contact Person

Return for Period of:

4. Eligible Tax Reverted Property Specifi c Tax

Telephone Number

Return Due Date

5. TOTAL DUE (add boxes 1-4 above)

CERTIFICATION AND SIGNATURE. I certify to the best of my knowledge that the amount

Make check payable to “State of Michigan” and mail

listed is the full amount due the State of Michigan.

with return to:

Dept. 77627

Signature

Date

Michigan Department of Treasury

P.O. Box 77000

Detroit, MI 48277-0627

Michigan Department of Treasury

2720 (Rev. 02/07)

TAX DUE

Issued under the authority of Public Acts 331 of 1993, 243 of 1959, as amended, 261 of 2000 and 260 of 2003.

1. State Education Tax

Return for Michigan State Education Tax, Mobile Home Tax,

Agriculture Property Recapture Tax and Eligible Tax Reverted

2. Mobile Home Tax

Property Specifi c Tax

County

Federal Employer Identifi cation Number

3. Agriculture Property Recapture Tax

Print Name of Contact Person

Return for Period of:

4. Eligible Tax Reverted Property Specifi c Tax

Telephone Number

Return Due Date

5. TOTAL DUE (add boxes 1-4 above)

CERTIFICATION AND SIGNATURE. I certify to the best of my knowledge that the amount

Make check payable to “State of Michigan” and mail

listed is the full amount due the State of Michigan.

with return to:

Dept. 77627

Signature

Date

Michigan Department of Treasury

P.O. Box 77000

Detroit, MI 48277-0627

1

1 2

2