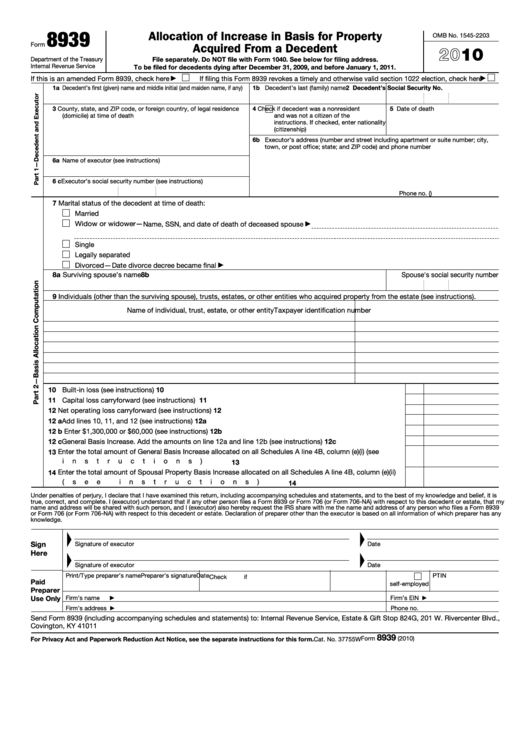

8939

Allocation of Increase in Basis for Property

OMB No. 1545-2203

Form

Acquired From a Decedent

2010

Department of the Treasury

File separately. Do NOT file with Form 1040. See below for filing address.

Internal Revenue Service

To be filed for decedents dying after December 31, 2009, and before January 1, 2011.

If this is an amended Form 8939, check here

If filing this Form 8939 revokes a timely and otherwise valid section 1022 election, check here

1a Decedent’s first (given) name and middle initial (and maiden name, if any)

1b Decedent’s last (family) name

2 Decedent’s Social Security No.

3 County, state, and ZIP code, or foreign country, of legal residence

4

Check if decedent was a nonresident

5 Date of death

(domicile) at time of death

and was not a citizen of the U.S. See

instructions. If checked, enter nationality

(citizenship)

6b Executor’s address (number and street including apartment or suite number; city,

town, or post office; state; and ZIP code) and phone number

6a Name of executor (see instructions)

6 c Executor’s social security number (see instructions)

Phone no. (

)

7 Marital status of the decedent at time of death:

Married

Widow or widower— Name, SSN, and date of death of deceased spouse

▶

Single

Legally separated

Divorced— Date divorce decree became final

▶

8a Surviving spouse’s name

8b Spouse's social security number

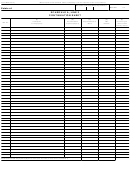

9 Individuals (other than the surviving spouse), trusts, estates, or other entities who acquired property from the estate (see instructions).

Name of individual, trust, estate, or other entity

Taxpayer identification number

10 Built-in loss (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11 Capital loss carryforward (see instructions) .

11

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12 Net operating loss carryforward (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

12 a Add lines 10, 11, and 12 (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12a

12 b Enter $1,300,000 or $60,000 (see instructions) .

12b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12 c General Basis Increase. Add the amounts on line 12a and line 12b (see instructions) .

.

.

.

.

.

.

.

12c

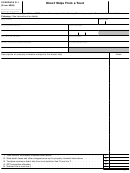

13 Enter the total amount of General Basis Increase allocated on all Schedules A line 4B, column (e)(i) (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14 Enter the total amount of Spousal Property Basis Increase allocated on all Schedules A line 4B, column (e)(ii)

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. I (executor) understand that if any other person files a Form 8939 or Form 706 (or Form 706-NA) with respect to this decedent or estate, that my

name and address will be shared with such person, and I (executor) also hereby request the IRS share with me the name and address of any person who files a Form 8939

or Form 706 (or Form 706-NA) with respect to this decedent or estate. Declaration of preparer other than the executor is based on all information of which preparer has any

knowledge.

Sign

Signature of executor

Date

Here

Date

Signature of executor

Print/Type preparer’s name

Preparer’s signature

Date

PTIN

Check

if

Paid

self-employed

Preparer

Use Only

Firm’s name

Firm’s EIN

▶

▶

Firm’s address

Phone no.

▶

Send Form 8939 (including accompanying schedules and statements) to: Internal Revenue Service, Estate & Gift Stop 824G, 201 W. Rivercenter Blvd.,

Covington, KY 41011

8939

Form

(2010)

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions for this form.

Cat. No. 37755W

1

1 2

2 3

3 4

4 5

5 6

6 7

7