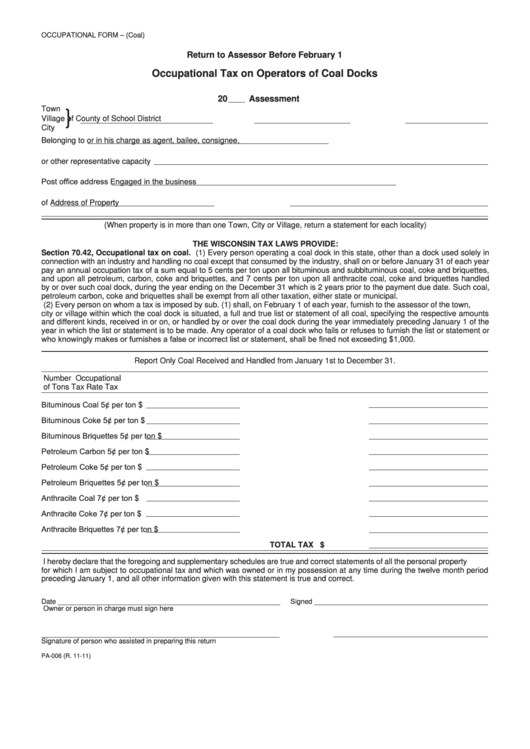

OCCUPATIONAL FORM – (Coal)

Return to Assessor Before February 1

Occupational Tax on Operators of Coal Docks

20

Assessment

Town

}

Village of

County of

School District

City

Belonging to

or in his charge as agent, bailee, consignee,

or other representative capacity

Post office address

Engaged in the business

of

Address of Property

(When property is in more than one Town, City or Village, return a statement for each locality)

THE WISCONSIN TAX LAWS PROVIDE:

Section 70.42, Occupational tax on coal. (1) Every person operating a coal dock in this state, other than a dock used solely in

connection with an industry and handling no coal except that consumed by the industry, shall on or before January 31 of each year

pay an annual occupation tax of a sum equal to 5 cents per ton upon all bituminous and subbituminous coal, coke and briquettes,

and upon all petroleum, carbon, coke and briquettes, and 7 cents per ton upon all anthracite coal, coke and briquettes handled

by or over such coal dock, during the year ending on the December 31 which is 2 years prior to the payment due date. Such coal,

petroleum carbon, coke and briquettes shall be exempt from all other taxation, either state or municipal.

(2) Every person on whom a tax is imposed by sub. (1) shall, on February 1 of each year, furnish to the assessor of the town,

city or village within which the coal dock is situated, a full and true list or statement of all coal, specifying the respective amounts

and different kinds, received in or on, or handled by or over the coal dock during the year immediately preceding January 1 of the

year in which the list or statement is to be made. Any operator of a coal dock who fails or refuses to furnish the list or statement or

who knowingly makes or furnishes a false or incorrect list or statement, shall be fined not exceeding $1,000.

Report Only Coal Received and Handled from January 1st to December 31.

Number

Occupational

of Tons

Tax Rate

Tax

Bituminous Coal

5¢ per ton

$

Bituminous Coke

5¢ per ton

$

Bituminous Briquettes

5¢ per ton

$

Petroleum Carbon

5¢ per ton

$

Petroleum Coke

5¢ per ton

$

Petroleum Briquettes

5¢ per ton

$

Anthracite Coal

7¢ per ton

$

Anthracite Coke

7¢ per ton

$

Anthracite Briquettes

7¢ per ton

$

TOTAL TAX

$

I hereby declare that the foregoing and supplementary schedules are true and correct statements of all the personal property

for which I am subject to occupational tax and which was owned or in my possession at any time during the twelve month period

preceding January 1, and all other information given with this statement is true and correct.

Date

Signed

Owner or person in charge must sign here

P.O. Address

Signature of person who assisted in preparing this return

PA-006 (R. 11-11)

1

1