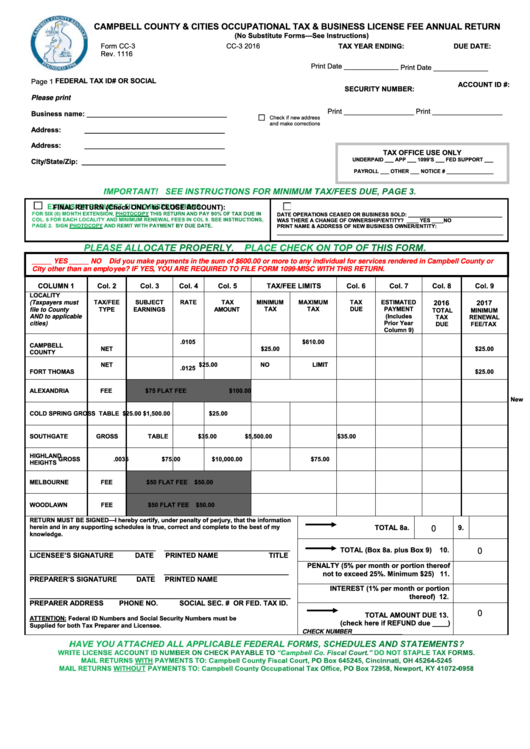

CAMPBELL COUNTY & CITIES OCCUPATIONAL TAX & BUSINESS LICENSE FEE ANNUAL RETURN

(No Substitute Forms—See Instructions)

Form CC-3

CC-3 2016

TAX YEAR ENDING:

DUE DATE:

Rev. 1116

Print Date ______________

Print Date ______________

FEDERAL TAX ID# OR SOCIAL

Page 1

ACCOUNT ID #:

SECURITY NUMBER:

Please print

Print __________________ Print __________________

Business name: ____________________________________

Check if new address

and make corrections

Address:

____________________________________

Address:

____________________________________

TAX OFFICE USE ONLY

UNDERPAID ___ APP ___ 1099’S ___ FED SUPPORT ___

City/State/Zip: _____________________________________

PAYROLL ___ OTHER ___ NOTICE # ________________

FINAL RETURN (Check ONLY to CLOSE ACCOUNT):

DATE OPERATIONS CEASED OR BUSINESS SOLD: ________________________________

WAS THERE A CHANGE OF OWNERSHIP/ENTITY? ____ YES ____NO

PRINT NAME & ADDRESS OF NEW BUSINESS OWNER/ENTITY:

_____________________________________________________________________________

_____ YES _____ NO

Did you make payments in the sum of $600.00 or more to any individual for services rendered in Campbell County or

City other than an employee? IF YES, YOU ARE REQUIRED TO FILE FORM 1099-MISC WITH THIS RETURN.

COLUMN 1

Col. 2

Col. 3

Col. 4

Col. 5

TAX/FEE LIMITS

Col. 6

Col. 7

Col. 8

Col. 9

LOCALITY

TAX/FEE

SUBJECT

RATE

TAX

MINIMUM

MAXIMUM

TAX

ESTIMATED

2016

2017

(Taxpayers must

TYPE

EARNINGS

AMOUNT

TAX

TAX

DUE

PAYMENT

TOTAL

MINIMUM

file to County

(Includes

TAX

RENEWAL

AND to applicable

Prior Year

DUE

FEE/TAX

cities)

Column 9)

CAMPBELL

NET

.0105

$25.00

$610.00

$25.00

COUNTY

$25.00

NO LIMIT

FORT THOMAS

NET

.0125

$25.00

ALEXANDRIA

FEE

$75 FLAT FEE

$100.00

New in 2017

COLD SPRING

GROSS

TABLE

$25.00

$1,500.00

$25.00

SOUTHGATE

GROSS

TABLE

$35.00

$5,500.00

$35.00

HIGHLAND

GROSS

.0035

$75.00

$10,000.00

$75.00

HEIGHTS

MELBOURNE

FEE

$50 FLAT FEE

$50.00

WOODLAWN

FEE

$50 FLAT FEE

$50.00

RETURN MUST BE SIGNED—I hereby certify, under penalty of perjury, that the information

TOTAL 8a.

9.

herein and in any supporting schedules is true, correct and complete to the best of my

0

knowledge.

_____________________________________

_____________________________________

TOTAL (Box 8a. plus Box 9)

10.

0

LICENSEE’S SIGNATURE

DATE

PRINTED NAME

TITLE

PENALTY (5% per month or portion thereof

________________________________

________________________________

not to exceed 25%. Minimum $25) 11.

PREPARER’S SIGNATURE

DATE

PRINTED NAME

INTEREST (1% per month or portion

___________________________________________________________________

thereof) 12.

PREPARER ADDRESS

PHONE NO.

SOCIAL SEC. # OR FED. TAX ID.

0

TOTAL AMOUNT DUE 13.

ATTENTION: Federal ID Numbers and Social Security Numbers must be

(check here if REFUND due ____)

Supplied for both Tax Preparer and Licensee.

_____________

CHECK NUMBER

1

1 2

2 3

3