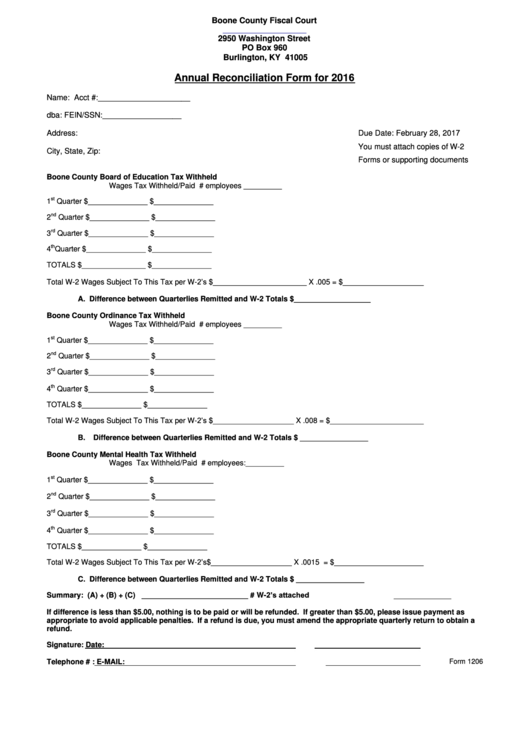

Boone County Fiscal Court

2950 Washington Street

PO Box 960

Burlington, KY 41005

Annual Reconciliation Form for 2016

Name:

Acct #:_____________________

dba:

FEIN/SSN:__________________

Address:

Due Date: February 28, 2017

You must attach copies of W-2

City, State, Zip:

Forms or supporting documents

Boone County Board of Education Tax Withheld

Wages

Tax Withheld/Paid

# employees _________

st

1

Quarter

$______________

$______________

nd

2

Quarter

$______________

$______________

rd

3

Quarter

$______________

$______________

th

4

Quarter

$______________

$______________

TOTALS

$_______________

$______________

Total W-2 Wages Subject To This Tax per W-2’s $______________________ X .005 = $___________________

A. Difference between Quarterlies Remitted and W-2 Totals $__________________

Boone County Ordinance Tax Withheld

Wages

Tax Withheld/Paid

# employees _________

st

1

Quarter

$______________

$______________

nd

2

Quarter

$______________

$______________

rd

3

Quarter

$______________

$______________

th

4

Quarter

$______________

$______________

TOTALS

$______________

$______________

Total W-2 Wages Subject To This Tax per W-2’s $___________________ X .008 = $______________________

B.

Difference between Quarterlies Remitted and W-2 Totals $ ________________

Boone County Mental Health Tax Withheld

Wages

Tax Withheld/Paid

# employees:_________

st

1

Quarter

$______________

$______________

nd

2

Quarter

$______________

$______________

rd

3

Quarter

$______________

$______________

th

4

Quarter

$______________

$______________

TOTALS

$______________

$______________

Total W-2 Wages Subject To This Tax per W-2’s$___________________ X .0015 = $_____________________

C. Difference between Quarterlies Remitted and W-2 Totals $ ________________

# W-2’s attached

Summary: (A) + (B) + (C) _________________________

If difference is less than $5.00, nothing is to be paid or will be refunded. If greater than $5.00, please issue payment as

appropriate to avoid applicable penalties. If a refund is due, you must amend the appropriate quarterly return to obtain a

refund.

Signature:

Date:

Telephone # :

E-MAIL:

Form 1206

1

1