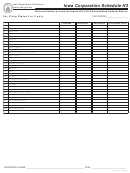

Form 42-021b - Iowa Corporation Schedule H1

ADVERTISEMENT

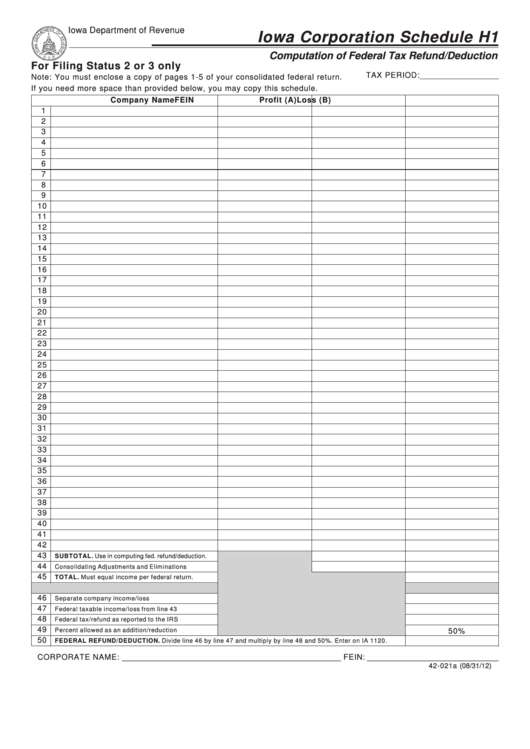

Iowa Department of Revenue

Iowa Corporation Schedule H1

Computation of Federal Tax Refund/Deduction

For Filing Status 2 or 3 only

TAX PERIOD: __________________

Note: You must enclose a copy of pages 1-5 of your consolidated federal return.

If you need more space than provided below, you may copy this schedule.

Company Name

FEIN

Profit (A)

Loss (B)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

SUBTOTAL. Use in computing fed. refund/deduction.

44

Consolidating Adjustments and Eliminations

45

TOTAL. Must equal income per federal return.

46

Separate company income/loss

47

Federal taxable income/loss from line 43

48

Federal tax/refund as reported to the IRS

49

Percent allowed as an addition/reduction

50%

50

FEDERAL REFUND/DEDUCTION. Divide line 46 by line 47 and multiply by line 48 and 50%. Enter on IA 1120.

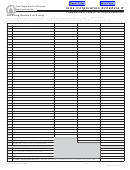

CORPORATE NAME: __________________________________________________ FEIN: ______________________________

42-021a (08/31/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

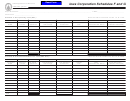

Parent category: Financial

1

1 2

2 3

3 4

4