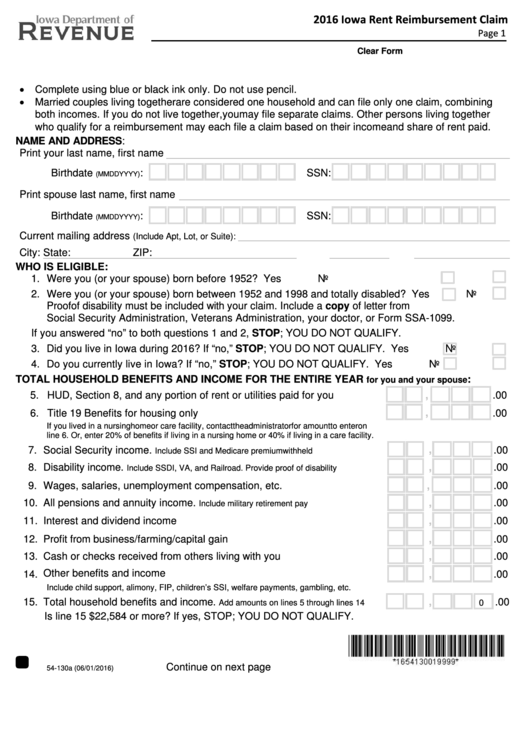

2016 Iowa Rent Reimbursement Claim

Page 1

https://tax.iowa.gov

Clear Form

• Complete using blue or black ink only. Do not use pencil.

• Married couples living together are considered one household and can file only one claim, combining

both incomes. If you do not live together, you may file separate claims. Other persons living together

who qualify for a reimbursement may each file a claim based on their income and share of rent paid.

NAME AND ADDRESS:

Print your last name, first name

Birthdate

:

SSN:

(MMDDYYYY)

Print spouse last name, first name

Birthdate

:

SSN:

(MMDDYYYY)

Current mailing address

(Include Apt, Lot, or Suite):

City:

State:

ZIP:

WHO IS ELIGIBLE:

1. Were you (or your spouse) born before 1952? ....................................................... Yes

No

2. Were you (or your spouse) born between 1952 and 1998 and totally disabled? .... Yes

No

Proof of disability must be included with your claim. Include a copy of letter from

Social Security Administration, Veterans Administration, your doctor, or Form SSA-1099.

If you answered “no” to both questions 1 and 2, STOP; YOU DO NOT QUALIFY.

3. Did you live in Iowa during 2016? If “no,” STOP; YOU DO NOT QUALIFY. ........... Yes

No

4. Do you currently live in Iowa? If “no,” STOP; YOU DO NOT QUALIFY. ................. Yes

No

TOTAL HOUSEHOLD BENEFITS AND INCOME FOR THE ENTIRE YEAR

:

for you and your spouse

5. HUD, Section 8, and any portion of rent or utilities paid for you .................

,

.00

6. Title 19 Benefits for housing only ...............................................................

,

.00

If you lived in a nursing home or care facility, contact the administrator for amount to enter on

line 6. Or, enter 20% of benefits if living in a nursing home or 40% if living in a care facility.

7. Social Security income.

.......................

,

.00

Include SSI and Medicare premium withheld

8. Disability income.

...............

,

.00

Include SSDI, VA, and Railroad. Provide proof of disability

9. Wages, salaries, unemployment compensation, etc. ...................................

,

.00

10. All pensions and annuity income.

..........................

,

.00

Include military retirement pay

11. Interest and dividend income .......................................................................

,

.00

12. Profit from business/farming/capital gain .....................................................

,

.00

13. Cash or checks received from others living with you ...................................

,

.00

14. Other benefits and income ...........................................................................

,

.00

Include child support, alimony, FIP, children’s SSI, welfare payments, gambling, etc.

15. Total household benefits and income.

,

.00

Add amounts on lines 5 through lines 14 .......

Is line 15 $22,584 or more? If yes, STOP; YOU DO NOT QUALIFY.

Continue on next page

54-130a (06/01/2016)

1

1 2

2