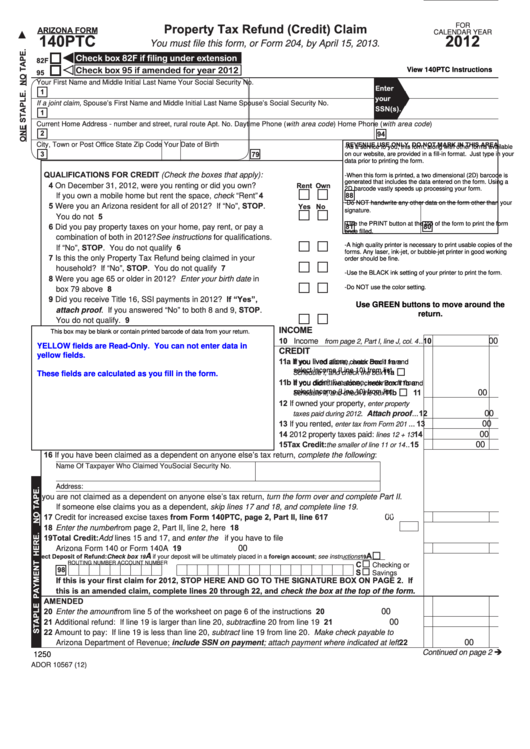

FOR

Property Tax Refund (Credit) Claim

Reset

ARIZONA FORM

CALENDAR YEAR

140PTC

2012

You must file this form, or Form 204, by April 15, 2013.

Print Return

Check box 82F if filing under extension

82F

View 140PTC Instructions

Check box 95 if amended for year 2012

95

Your First Name and Middle Initial

Last Name

Your Social Security No.

Enter

1

your

If a joint claim, Spouse’s First Name and Middle Initial

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No.

Daytime Phone (with area code)

Home Phone (with area code)

2

94

City, Town or Post Office

State Zip Code

Your Date of Birth

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

-As a service to you, this form, along with other forms available

3

79

on our website, are provided in a fill-in format. Just type in your

data prior to printing the form.

QUALIFICATIONS FOR CREDIT (Check the boxes that apply):

-When this form is printed, a two dimensional (2D) barcode is

generated that includes the data entered on the form. Using a

4 On December 31, 2012, were you renting or did you own?

Rent Own

2D barcode vastly speeds up processing your form.

If you own a mobile home but rent the space, check “Rent” .......

4

88

-Do NOT handwrite any other data on the form other than your

5 Were you an Arizona resident for all of 2012? If “No”, STOP.

Yes

No

signature.

You do not qualify........................................................................

5

-Use the PRINT button at the top of the form to print the form

6 Did you pay property taxes on your home, pay rent, or pay a

81

80

once filled.

combination of both in 2012? See instructions for qualifications.

-A high quality printer is necessary to print usable copies of the

If “No”, STOP. You do not qualify ...............................................

6

forms. Any laser, ink-jet, or bubble-jet printer in good working

7 Is this the only Property Tax Refund being claimed in your

order should be fine.

household? If “No”, STOP. You do not qualify ..........................

7

-Use the BLACK ink setting of your printer to print the form.

8 Were you age 65 or older in 2012? Enter your birth date in

-Do NOT use the color setting.

box 79 above ..............................................................................

8

9 Did you receive Title 16, SSI payments in 2012? If “Yes”,

Use GREEN buttons to move around the

attach proof. If you answered “No” to both 8 and 9, STOP.

return.

You do not qualify. .......................................................................

9

Go to Income: Page 2 Part I

INCOME

This box may be blank or contain printed barcode of data from your return.

00

10 Income

.. 10

from page 2, Part I, line J, col. 4

YELLOW fields are Read-Only. You can not enter data in

CREDIT

yellow fields.

11a If you lived alone,

If you lived alone, check Box 11a and

enter credit from

…

select income (Line 10) from list

......11a

Schedule I, and check the box

These fields are calculated as you fill in the form.

11b If you didn’t live alone,

If you didn't live alone, check Box 11b and

enter credit from

…

select income (Line 10) from list

00

.....11b

11

Schedule II, and check the box

12 If owned your property,

enter property

00

. Attach proof ... 12

taxes paid during 2012

00

13 If you rented,

... 13

enter tax from Form 201

00

14 2012 property taxes paid:

14

lines 12 + 13

00

15 Tax Credit:

.. 15

the smaller of line 11 or 14

16 If you have been claimed as a dependent on anyone else’s tax return, complete the following:

Name Of Taxpayer Who Claimed You

Social Security No.

Address:

If you are not claimed as a dependent on anyone else’s tax return, turn the form over and complete Part II.

If someone else claims you as a dependent, skip lines 17 and 18, and complete line 19.

Go to Page 2 Part II

00

17 Credit for increased excise taxes from Form 140PTC, page 2, Part II, line 6 ............................................. 17

18 Enter the number from page 2, Part II, line 2, here ...........................................................................18

19 Total Credit: Add lines 15 and 17, and enter the total. See page 5 of the instructions if you have to file

00

Arizona Form 140 or Form 140A .................................................................................................................... 19

…

A

A

Direct Deposit of Refund: Check box

if your deposit will be ultimately placed in a foreign account; see instructions ......

19

19

…

ROUTING NUMBER

ACCOUNT NUMBER

C

Checking or

…

98

S

Savings

If this is your first claim for 2012, STOP HERE AND GO TO THE SIGNATURE BOX ON PAGE 2. If

this is an amended claim, complete lines 20 through 22, and check the box at the top of the form.

AMENDED

00

20 Enter the amount from line 5 of the worksheet on page 6 of the instructions ................................................ 20

00

21 Additional refund: If line 19 is larger than line 20, subtract line 20 from line 19 ............................................ 21

22 Amount to pay: If line 19 is less than line 20, subtract line 19 from line 20. Make check payable to

00

Arizona Department of Revenue; include SSN on payment; attach payment where indicated at left ......... 22

Continued on page 2 Î

1250

ADOR 10567 (12)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8